Is 0% financing for a car really a good deal?

Anyone who has bought a new car in the past 10 years has probably had an option for really low interest or even 0% financing. With interest rates at historical lows, 0% financing is popping up as an interesting option again. That being said, it is really no interest? Is it really a good deal?

Not everyone qualifies

To get 0% financing, you have to qualify based on having good credit. According to the National Automobile Dealers Association, only a third of buyers who apply for 0% financing actually qualify.Ironically, those people that can use the interest break, may not qualify.

What’s the catch?

Just because you receive 0% financing doesn’t mean you are getting the best deal possible. Let’s look at a simple comparison to uncover the mystery behind 0% financing.

Paying cash saves you money

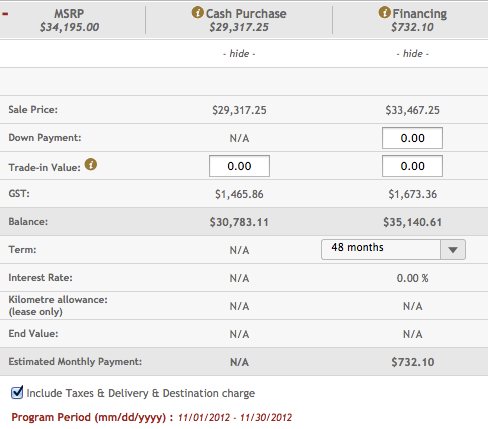

I recently came across the KIA website when researching the KIA Sedona minivan for our family. On the site, they show that there is a price difference between 0% financing and paying cash.

As you can see, if you pay cash, you can save $3500 off the purchase price. In effect, this is the cost of financing.

If you financed $30,967.25 over 48 months at 5.35% interest, the total cost of that loan would be the equivalent of the 0% financing purchase price of $34,467.97. In essence, 0% financing is really costing you 5.35% because you are paying a higher price.

Different times, different deals

As you can see in the image above, the numbers were run in the month of October 2012. As this article was being posted in November, I decided to run the numbers again and the prices had dropped. Interestingly, the 0% financing price dropped $1,000 while the cash price dropped more $1,660.

With the higher price differential, the interest cost on the 0% financing option actually increases to 6.65%. This was shocking to me but it does prove that different deals happen at different times.

As you can clearly see, 0% financing is not really interest free. I really appreciate that KIA makes the difference so clear with their online price comparison. At the end of the day, Kia is still going to make money. I just like the transparency so people like me can really analyze the numbers.

What do you think of the analysis? Did I miss anything?

Comments

If the car has a “0%” financing offer attached to it, the price somehow has it built into it in a hidden way. I have gone to dealers worked out pricing then told them at the end “what if I pay cash?”. The conversations usually go very south from there or suddenly that price is not available. I find that frustrating about dealers, they just play with numbers until they find a way to shaft you in the most comfortable way for you. You should also consider buying a good used vehicle, and invest the difference.

Your analysis confirms once again: There is no free lunch. 0% financing is a sales gimmick, nothing more or less.

When I bought my last new car, a Toyota, I specifically asked if there was a better deal if I paid cash rather than took their offer of 0 per cent financing. I was told the price was the same either way. That car is now paid off but I’ve wondered if I could have negotiated a better deal or if I was misled. Thoughts?

Until the end of November, Mazda.ca advertises

free financing or $2000 off the MSRP if you

pay cash.

So your so called free financing actually costs

$2000.

I always say…..nothing is for free!!!!!!

So if you pay cash you save $4,357 on the interest vs financing. Now if i were to invest that $30,783 and received an average return of 5% over 4 years i could earn $6,634 in interest on that money. I know that a %5 return isnt guaranteed and it could either be a worse return but it could also be a better return. So i wonder if paying cash is really the way to go? Has anyone else considered this? Can you find any fault in my approach?

I work in car sales and can tell you that there are exceptions however typically any company offering 0% will most often also offer a substantional cash discount that is equal to the interest savings. Thus, Making it the same price whether or not you finance or pay cash, the cash discount comes from the manufacturer so the dealership doesn’t really care if you finance or pay cash, we get a cheque from the manufacturer for the full price of the car either way.

With that being said, most often it is better to take the financing and instead invest the money you were going to use into some sort of guaranteed investment. This also keeps you borrowing other peoples money and saving your own for better investments or a rainy day. Another important point is almost all car loans are open these days and can be paid off at anytime