More Canadians plan to work past 65

Retirement is changing in big ways and one of the biggest drivers of change is the baby boomers. The baby boom started back in 1946 and for 20 years, there was a massive number of babies born. The earliest boomer has turned 65 and for the next 20 years, we are about to see a massive number of people deal with retirement.

Related article: The changing face of retirement

For the past 15 years, I have been teaching retirement workshops and one of the biggest changes to planning is that more and more of these boomers are planning to work in retirement.

Sun Life has just released its Fifth annual Unretirement Index survey. New research by Sun Life and their Unretirement index suggests that the latest trend is that boomers are planning to work longer and retire later. Heres some of their key findings.

Fewer Canadians plan to be retired at 66

For the first time in five years of tracking retirement trends, the index found that the number of Canadians who expect to be retired at 66 (27 percent) is almost equal to Canadians who expect to be working full time at 66 (26 percent) and almost another third (32 percent) expect to be working part-time at 66.

“The dream of being able to afford a full retirement at age 66 is declining among Canadians, it’s being replaced by the reality that many people expect to be working beyond the traditional retirement age,” said Kevin Dougherty, President, Sun Life Financial Canada. “The aftermath of the financial crisis of 2008 has had a lasting impact with more Canadians expecting they will need to work longer as a result.”

Why are Canadians planning to work past 65?

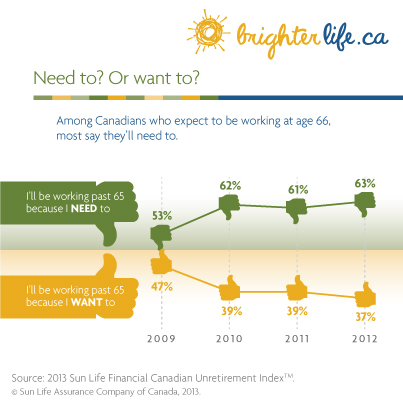

The survey revealed that more Canadians are expecting to work past 66 because of necessity and fear of outliving their savings:

- 63 percent expect they will need to work past 66 compared with 37 percent wanting to work.

- With Canadians expecting to be retired for an average of 20 years, over a third (38 percent) say there is a serious risk of outliving their retirement savings.

- Almost a third (31 percent) of Canadians are not at all confident that they will have enough for medical expenses.

The survey also found that Canadians have a gap in their thinking about retirement savings. They anticipate requiring an average income of $46,000 per year for their retirement yet they are only aiming to have $385,687 in retirement savings (excluding their home and other property).

At the same time, only a quarter of Canadians (23 percent) stated saving for retirement was their number one priority. Paying down debt or credit cards was the number one priority for nearly half of Canadians. The priority placed on saving for retirement varies with age. It was a top financial priority for 37 percent of early Boomers in the 57 to 65 year age group. The number dropped to 12 percent of people in Generation X – 30 to 46-year-old age group – who say it’s their top financial priority.

In terms of their investments, interest rates are on the minds of Canadians. Twice as many Canadians (25 percent) want the interest rate to go up in 2013, compared with the number who want to see it decline (13 percent). There are also differences in age groups. Thirty-one percent of early boomers (age 57 to 65) want to see the interest rate rise compared to 24 percent of Gen Xers (age 30 to 46) and late boomers (age 47 to 56).

Click here If you want to take the Unretirement index online tool

Comments

I’m not clear about this: “The survey also found…Canadians…anticipate requiring $46,000 per year for retirement yet they are only aiming to have $385,687 in retirement savings.” Do they mean they need $46k from their savings on top of their CPP, OAS and any work pension plan? If you have, say, a teacher’s pension plan, you could easily have the $46k from your work pension, OAS and CPP without having any personal savings.

Bet

I would be 99% sure that the $46k is inclusive of CPP, OAS and any company pension plan, so as you say some teachers or others with good pension plans shouldn’t need any additional savings to reach the $46k income. The problem with averaging though, is that this group of people would probably have a higher target than the average of $46k.

If one works Two years post 65, i believe then one would get Post Retirement Benefit (PRB) for these Two years.

Now let’s say these Two post 65 years’ were replaced for two pre 65 years in the final cpp benefit calculation. (pre 65 years were @ 50% cpp, and post 65 years were max cpp).

Questions:

1) Would still these Two post 65 years get PRB?

2) Would these Two post 65 years’ contributions

be included in 142% as well if this guy takes

Cpp benefits @ the age of 70?

Thanks very much.

Hi Sam – You only get PRBs for earnings after you start receiving your CPP, so:

1) No

2) Yes