Retirement income options for a DC Pension plan?

Recently I wrote about theoretical retirement income options from a Defined Benefit Pension and a Defined contribution Pension.

Related articles: Defined Contribution Pension Options at retirement and Defined Benefit pension options at retirement

This week, I would like to look at this from a more practical perspective via a case study of Paula.

Paula has turned 60 this year and is getting ready for retirement. Although she has a pension through work, it’s a Defined Contribution pension and her biggest concern is knowing how much income she will get from her pension plan. Let’s take a look at her retirement income options.

Background

The DC Pension plan is at Sun Life. It is invested in a few different mutual funds and sitting with about 65% equities and 35% fixed income investments. The pension has done quite well because of the strong market growth over the past 3 years. She has made over 12% compound annual returns over the past few years which has helped her to accumulate $450,000 in her pension. Paula is divorced with 2 adult children who are both financially independent. She has owns her own home and has no debts. She has another $110,000 in RRSPs and $38,000 in her TFSA.

Pension to Life Annuity

When Paula retires, she will be faced with a number of differentretirementincome options. The first option to explore is the Life Annuity. With a Life Annuity it’s important to get quotes from a financial advisor or from different insurance companies.

Related article: Important things to know about Life Annuities

Life Annuity rates will change on a daily basis so it’s important to always shop around for the best deal. After getting some quotes from a financial advisor licensed to sell Life Annuities, here’s a summary of three quotes:

- Great West Life = $2201.57 per month

- Sun Life = $2173.83 per month

- Manulife = $2015.69 per month

Obviously, the best deal for Paula isGWL who will pay Paula about $26,418 per year in pension income. This is a lifetime income which means it pays until she dies. She will never outlive her income. The income is secure and predictable. However, if Paula passes away early, there is no return of capital to her after 5 years.

Related article: The math of life annuities

Pension to LIF

A Life Income Fund (LIF) is a little more flexible but as a result also a little more complicated. With the LIF, you can set the income to whatever you want as long as it is within a minimum and maximum. While that may sound simple, the complexity comes in that the minimum and maximum changes every year. Here’s some scenarios to look at:

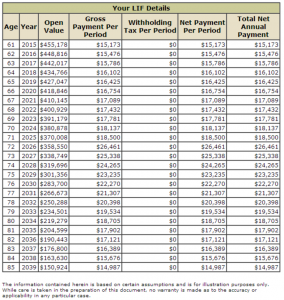

1. Minimum income LIF. The minimum income levels for the LIF are exactly the same as the minimum income levels for the RRIF. Here’s a look at what the minimum income LIF would look like for $450,000

As you can see, the minimum income starts much lower than the Life annuity ($15,173 vs $26,418 per year) but increases as Paula gets older. I used a very conservative return assumption of 2% for illustration purposes only. Remember that the minimum income will change as rates of return change. This chart was produced with financial calculators from Mackenzie Financial. You can play with this data and use your own set of assumptions.

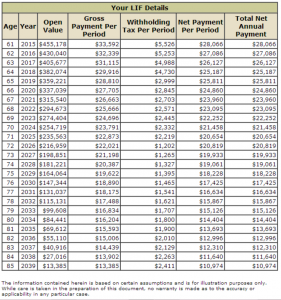

2. Maximum Income LIF. Unlike a RRIF where there is no maximum income restriction, the LIF has an annual maximum that also changes year by year.

From this illustration, you can see that the initial income is much higher than the Life Annuity ($33,592 vs $26,418) but the income decrease over time. Again, this is based on a very conservative 2% rate of return assumption. A higher return can dramatically change the income values over time.

The LIF offers much greater flexibility from theperspectivethat you can set your income amount (subject to minimums and maximums) and you can change your income anytime. With the LIF, you are responsible for making investment decisions which for some is an advantage but for others a disadvantage.

A Life Annuity will benefit those that live a long time because the income is guaranteed for life. Those that have shorter life expectancies will benefit with the LIF because there is always an estate value. What you don’t use in the LIF will be passed on to beneficiaries. If will be taxed first to the estate but beneficiaries are likely to get something.

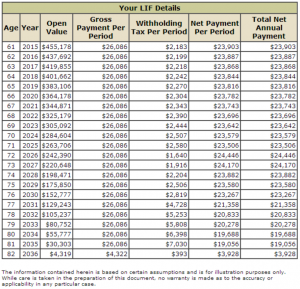

3. Level income LIF. Most people prefer to have a level consistent income in retirement as opposed to one that increases or decreases over time. If we set the income at the same level as the Life Annuity ($26,418 per year), we can see the breakeven point based on a 2% return.

As you can see in this illustration, money runs out at age 81. If you think you will live longer than age 81, then a Life Annuity might make more sense. If you think you will die before age 81, the LIF will make better sense.

Related article: The difference between LIRAs and RRSPs

50% unlocking

To complicate matters a little more, Alberta has pension unlocking rules. As you can see from the information above, pension rules can make it quite restrictive to access extra money from a pension plan. Given that many people were unable to use all their pension money in their lifetime, some provinces introduced unlocking rules. In Alberta, were Paula lives, she is able to unlock 50% of the pension funds and transfer it to a RRSP or RRIF which has no withdrawal restrictions or income maximums.

Related article: Unlocking pension money: Getting money out of LIRAs

Issues and considerations

In looking at these numbers, the Life annuity looks not too bad but it does not give Paula any flexibility. Life annuities are great for their predictability and simplicity but most people are not choosing life annuities because of low interest rates and lack of flexibility. Life annuities are also great if Paula lives for a long time.

Choosing the LIF gives Paula much more flexibility in choosing income. These projections are using a 2% return so any increase in returns can increase the income.

Paula could always transfer the LIF to an annuity in the future if interest rates increase. She could not move from an annuity to a LIF because once she purchases the annuity, she is locked in for life.

Choosing a life annuity is not great for estate planning purposes as her children may not get any money from the annuity. That’s where the LIF has a greater appeal because any money Sally does not use can be given to the children or grandchildren at death (subject to taxation).

After showing Paula all the information, she decided the LIF was the best way to go. She decided to unlock 50% to a RRIF and move the other 50% to a LIF. With the LIF, she chose a maximum income ($1400 per month) and then set the RRIF at $1085 per month.

Did Paula do the right thing? What would you have done?

Comments

A solid decision, I think the more financial flexibility you can keep with your portfolio, although the options may make you dizzy, the better Jim.

My wife has a DC plan, I think in time, the best solution will be a LIF for her.

Mark

Is there any thought to spliting the 450k between the two options. This would give some flexibility from the LIF and guarenteed income from the annuity.

Yes you can do both. It’s not an “All or None” decision. you can go from a LIF to a Life Annuity but you cannot go from a Life Annuity to a LIF.

This article is very informative. Thank you!

VERY helpful article, thank you.

Hi Jim,

Can I open two self-directed LIF accounts (with different discount brokers) with DC pension plan funds? I live in Nova Scotia (if that makes a difference).

Thanks

Ram

If there is a portion of a Pension that is employee voluntary and some that is contributed by the employer is there different rules for accessing those funds or do they form the entire pension and are bound by the same rules?

I have a DC pension plan and just retired at age 65. The plan has approximately $200,000. Manulife will be depositing this money to my account as a one time payout. The issue is that I am not sure what is my best option. Do you have any suggestions?

Why was there no Withholding Tax in the Minimum Income LIF table, but withholding tax in the Maximum and Level income tables? Also, why did the withholding tax fluctuate so much in the level income table?