Can we retire now? Retirement rules of thumb

John and Jennifer (Jen) are 62 and want to retire comfortably soon. Can they retire now? They want to know how to set up their retirement income to give them the maximum income that will be reliable for the rest of their life.

They have been investing for years and have $1 million in retirement investments. Is that enough?

They make an income of $100,000 per year and are scared to stop working and give it up.

They went to see a financial advisor and received this advice:

- 70% Replacement ratio: They will need $70,000 per year income in retirement. Based on the “replacement ratio” rule of thumb, they will need 70% of their pre-retirement income.

- 4% Rule: They can withdraw $40,000 per year and increase it every year by inflation from their $1 million in investments, based on the “4% Rule”. Add roughly $30,000 from CPP and OAS to give them the $70,000 per year they need, so they have enough.

- Age rule: They are getting older so they should invest more conservatively based on the “Age Rule”. The should invest 100 minus their age in stocks. Since they are age 62, they should have 38% in stocks and 62% in bonds.

- Sequence of returns: They should invest conservatively because they can’t afford to take a loss. They could run out of money because of the “sequence of returns”. If they would have investment losses early in their retirement, their investments would not recover.

- Delay CPP to age 65: They were told this is a “guaranteed return of 7.2% per year”, because they will get 7.2% more for each year they wait.

- Cash buffer: They should keep cash on hand equal to 2 years of their income from their investments to draw on when their investments are down. Since they could withdraw $40,000 per year from their investments, they should keep $80,000 of their investments in cash.

John & Jen came to see me because they were still hesitant to quit their jobs. They said this advice is from rules of thumb and not specifically for them.

They asked me, “Is this good advice for us? Can we really retire now?”

I told them, “I see this type of canned advice a lot. These rules of thumb have been handed down from one generation of financial advisors to the next. The rules appear to be common sense and are usually accepted without question. Here are the first 3 things you need to know:

- You need a personalized Retirement Plan. Don’t base your future on rules of thumb.

- These rules of thumb are not supported by history. I studied 146 years of history of stocks, bonds and inflation and found these common rules of thumb are generally not You can read the study here: “How to Reliably Maximize Your Retirement Income – Is the “4% Rule” Safe?“

- Maximum reliable retirement income. I can show you what really works to give you the maximum reliable retirement income – both how to set up your portfolio, manage your income and minimize your tax.”

We went through the Retirement Plan process in detail together. Here is what we decided:

Desired retirement lifestyle

John & Jen want a relatively comfortable retirement. They enjoy dining out and golf, want 2 reliable cars, and $10,000 per year for vacations. After we worked out their desired lifestyle in detail, they were surprised to find that they actually need $80,000 per year ($40,000 each before tax) to live the lifestyle they want.

I told them the 70% replacement ratio rule of thumb might be a reasonable average, but everyone is different. I have prepared Retirement Plans with as low as 45% and as high as 150% of preretirement income.

Decide on the life you want to live. Don’t settle for the income you get.

Investment allocation

John and Jen’s investments now are two equity funds and two balanced funds. They have 75% in equities and 25% in bonds. I asked how they felt about this mix. They said they had owned them for years and are comfortable with this risk level. They owned them in the crash in 2008 and did not sell.

However, they asked, “But should we invest more conservatively when we retire. Our time horizon is shorter and we can’t afford to take a loss, right?”

I told them they have a long-term time horizon and history does not support a safer retirement from investing more conservatively. They should invest based on their risk tolerance, not based on how they think they should invest.

Their time horizon is long. They are 62. In 50% of Canadian couples in their 60s, at least one of them makes it to age 94. Planning for their money to last until age 94 would be a 50% chance of running out of money. It would be better for them to plan for no more than a 25% chance of outliving their money. There is a 25% chance that one of them will live to age 98.

That means John and Jen have a 36-year time horizon, which is definitely long-term.

We had a detailed discussion of their risk tolerance. They confirmed they are comfortable with their existing investment risk. They would stay invested even in a large market decline. We decided to keep their investments at 75% in stocks and 25% in bonds.

Target withdrawal rate and the age rule

A target withdrawal rate can be an effective way to manage your retirement income after you retire, but 4% is not reliable for most seniors.

John & Jen asked me, “If we withdraw $40,000 per year (4%) from our $1 million in investments each year and increase it by inflation, is that reliable for the rest of our life?”

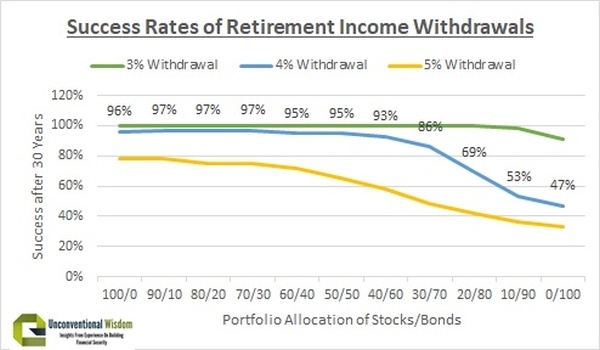

I told them that, based on history, the “4% Rule” was safe for equity-focused investors, but not for most seniors. In the image below, the blue line is the “4% Rule”, showing how often in the last 146 years a 4% withdrawal plus inflation provided a reliable income for 30 years with different portfolio allocations.

I explained that the “4% Rule” worked only if you invest with a minimum of 50% in stocks. Even safer is 70-100% in stocks. It is best to avoid a success rate below 95% or 97%. They mean a 1 in 20 or 1 in 30 chance of running out of money during your retirement.

I asked John and Jen how they felt about a 1 in 20 chance (95% success rate) of running out of money. They said a 1 in 30 chance felt better.

Most seniors invest more conservatively and the 4% Rule failed miserably for them. A “3% Rule” has been reliable in history (green line), but means you only get $30,000 per year plus inflation from a $1 million portfolio, instead of $40,000 per year.

Based on the “Age Rule” of thumb, John and Jen had been advised to invest 62% in bonds and increasing that by 1% every year. In a 36-year retirement from age 62 to 98, they would average 80% in bonds.

John and Jen were shocked to find that their chance of a successful retirement would only be 69% if they used the “Age Rule”. (Note the blue line for a 20/80 portfolio allocation.)

Since we had decided on 75% in stocks and 25% in bonds, the 4% Rule is reliable for them. It has worked 97% of the time in history.

John & Jen found this counter-intuitive. They asked, “The more you invest in stocks, the safer your retirement income would have been in history?”

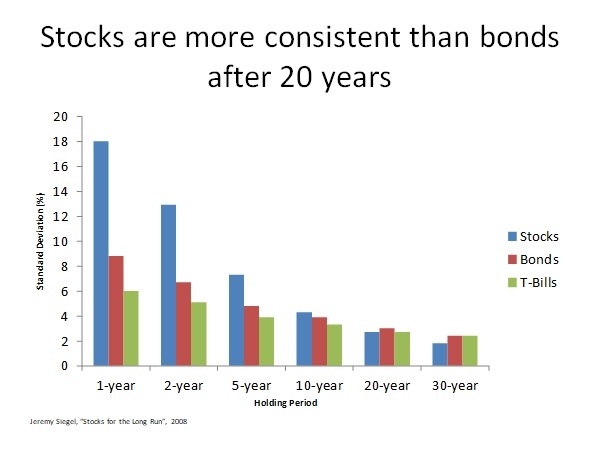

Yes. To understand this, it is important to understand that stocks are risky short-term, but reliable long-term. Bonds are reliable short-term, but can be risky long-term. Why? Bonds get killed by inflation or rising interest rates. If either happens during your retirement, you can easily run out of money with bonds.

The next chart illustrates this clearly. It shows the standard deviation (measure of risk) of stocks, bonds and cash over various time periods in the last 200 years. Note that stocks are much riskier short-term, but actually lower risk for periods of time longer than 20 years.

After seeing the history, John & Jen finally felt comfortable with a 4% target withdrawal rate for them, since they plan to maintain their 75% allocation to stocks.

Sequence of returns

John and Jen asked, “What about the ‘sequence of returns’? What happens if we have some bad investment years early in our retirement?”

I told them the “sequence of returns” is not supported at all by history. Retirement is long and stocks have almost always recovered any loss throughout history – even when you continue to withdraw your retirement income from them.

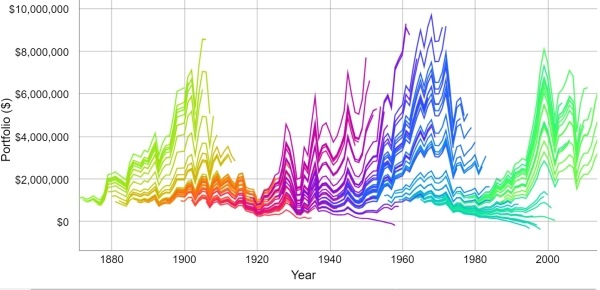

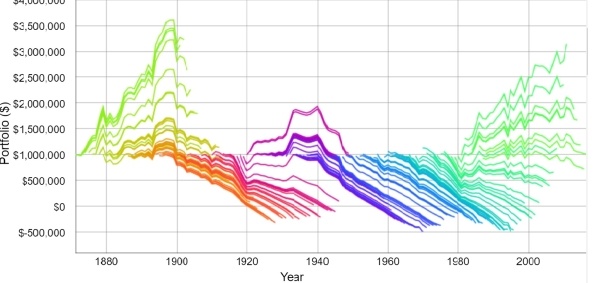

I showed them the charts below, based on US market history data since 1871 from Standard & Poors, Barclays and Bureau of Labour Statistics, which show actual history of the 4% Rule with 3 different investment allocations. Each line is a 30-year retirement. To see how successful retirement would have been, note how often the lines go below $0.

With 100% in equities, the success rate was 97%. There are 118 retirements of 30 years on this graph. Investing 100% in stocks, you would have run out of money only 5 times – 4 because of very high inflation and one because of a market crash.

Notice that there was a market recovery within a few years of almost all market declines, even though you continued with the same retirement income and increased it every year by inflation. There were quite a few market crashes in the last 146 years, but only once would you have run out of money because of a market crash (retiring in 1929).

In other words, the sequence of returns was an issue only once in the last 146 years.

Actual retirement success history: 100% equities with 4% withdrawal + inflation

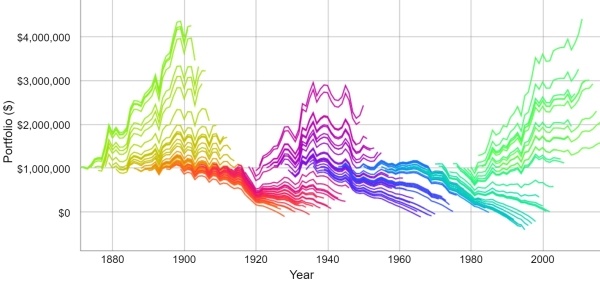

Most seniors invest more conservatively, such as with 70% bonds and 30% stocks. Their success rate was 86%. The data below shows that they would have run out of money 17 times.

Actual retirement success history: 70% bonds / 30% equities with 4% withdrawal + inflation

Because of the “sequence of returns”, the typical advice is to invest more conservatively with more bonds. This is not safer! The risk of running out of money with 70% in bonds is 3 ½ times higher than with 25% in bonds.

Then there’s the 4% Rule with 100% in bonds. There are 118 retirements of 30 years on this graph. Investing 100% in bonds meant you would have run out of money in 63 of them – more than half the time! If you retired almost any year between 1890 and 1980, you would have run out of money with 100% in bonds. Note how many of these lines drop below $0:

Actual retirement success history: 100% bonds with 4% withdrawal + inflation

I told John and Jen, “Don’t worry about sequence of returns. As long as you follow your plan, invest within your risk tolerance and stay invested, your investments can recover from almost any market decline.”

Start CPP at retirement

I explained to John and Jen that delaying CPP is not a “guaranteed rate of return of 7.2%”. They get 7.2% more CPP during their life and then their spouse gets 60% of that if the spouse outlives them. The rate of return depends on each specific situation but is closer to 5%.

Whether to take CPP early or delay it depends on many factors. I showed them my studies of “Should I start my CPP early?” and “Should I Delay CPP & OAS Until Age 70?“. They showed that how you invest is one of the main factors. In general, equity investors should take CPP earlier, while balanced and bond investors should delay it.

Now that I know their situation, I recommended to John and Jen to start their CPP at retirement.

Cash buffer

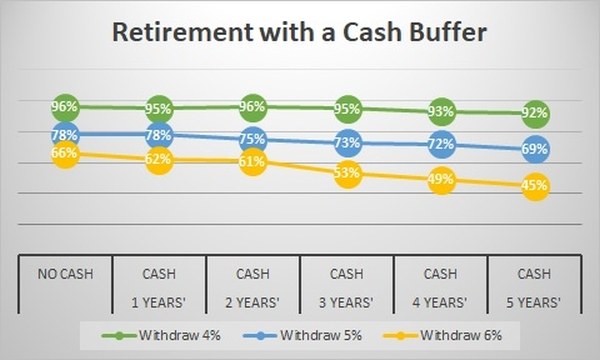

John and Jen asked whether they should hold cash equal to 2 years’ withdrawals to draw on when your investments are down. Then they could live off the cash and not touch their investments after a big down year, giving them some time to recover.

I told them that this sounds logical, but was not supported by the 146-year study. For example, assuming 100% in equities and various cash holdings, here are the success rates for a 30-year retirement with 3 different withdrawal rates:

In every case, holding cash either had no effect or increased the risk of running out of money. I could not find a single example of a retiring year or withdrawal amount when holding any amount of cash provided a higher success rate than holding no cash.

The study showed that holding cash does not protect you. In fact, it often increases your risk of running out of money. The drag on your returns from holding cash sometimes caused you to run out of money, but holding cash never protected you from running out of money.

This might be counter-intuitive. The reason is that retirement is long – say 30 years. Stocks usually recover from declines. Holding cash for 30 years means you lose out on a lot of income, plus the loss of purchasing power due to inflation.

In addition, if you hold cash, you will almost definitely die with a significantly smaller estate to pass on to your loved ones.

I told John and Jen, “It is safer not to hold cash.”

Retirement plan

John and Jen still have their original question, “Can we safely retire now?”

We created a proper retirement plan. Instead of using rules of thumb to estimate how much they might need, we used retirement planning software. I showed John & Jen that they need $1.15 million in retirement investments to have the retirement they want. They are 15% short.

Their retirement plan allows them to plan their life with 3 choices:

- Retire now at age 62 on $73,000. We discussed what lifestyle expenses they would cut $7,000/year. They could buy $20,000 cars instead of $30,000 cars and cut their travel from $10,000 to $6,000 per year.

- Work 1 ½ years and retire at 63 ½ on their desired $80,000 per year.

- Retire now on $80,000 with an advance retirement income strategy. There are many ways to manage your retirement income. My study found methods that had 100% success in history with withdrawal rates of 5% and even 6% of your investments if you manage your withdrawals effectively and can take a small decrease in some circumstances. You should be careful with these higher methods. They require carefully managing your income.

John and Jen prefer option B, to retire on their desired lifestyle. They realized from this process that they are not fully ready to retire today. They now have confidence they can retire in about 1 ½ years.

Jen said, “The retirement plan is very helpful for us to plan our life.”

Summary and tested advice on retirement income

What is the best way to set up your retirement income to give you the maximum income with the lowest risk of running out of money?

- Get your Retirement Plan. Plan your desired retirement. Work it out in detail so you are confident. Don’t use an “income replacement ratio”. Decide on the life you want to live. Don’t settle for the income you get.

- Equities are safer. Don’t assume you need to invest more conservatively just because you are retired. Retirement is for 30+ years. Consider keeping the same allocation you had before retiring. Equities are also taxed at much lower rates than bonds and GICs.

- You need cash flow, not income. Invest for long-term total return and then withdraw the cash flow you need. Don’t focus on income, like interest or dividends, if they would reduce your long-term total return. Systematic withdrawals (or “self-made dividends“) give you control and are the lowest taxed investment income.

- Equity investors can safely use the 4% Rule, as long as you invest at least 50-70% in equities.

- The “Age Rule” works with a “3% Rule”. There is nothing wrong with investing conservatively with the Age Rule, but then reduce your retirement income to withdraw only 3% of your investments each year. Fixed income is lower income. The more conservatively you invest, the lower your retirement income should be.

- Don’t worry about the “sequence of returns”. Worrying about it can lead you to hold more in bonds, which actually increases your risk of running out of money. Retirement is long and stocks have reliably bounced back in history.

- Be smart about your risk tolerance. Invest with the highest amount in stocks that is within your risk tolerance. That means you cannot make the “Big Mistake” – sell or invest more conservatively because of a market decline. The more conservatively you invest, the more likely you will run out of money (at any withdrawal amount). Get educated on stock and bond market history, so you have an accurate picture of risks and returns.

- Inflation is huge. Inflation typically makes the cost of living triple during your retirement. You need a rising income, not a fixed income. Inflation kills bonds, but not stocks.

- It is safer NOT to hold cash. Holding cash does not protect you and may increase your risk of running out of money. It almost definitely means you die with a smaller estate.

- Higher income is possible with effective management. You can have a higher income by withdrawing 5% or even 6% of your investments if you can manage your income effectively or are working with a financial planner who knows how to manage it effectively.

Comments

I retired almost one year and love it. Im 56yrs and my house is paid for.I own older 2004 vehicle which is ok,it paid for!! I have a Pension from the Federal Government which pays me $2900 a month.I have a Public service health care plan (PSHCP) but no dental plan.

I have 60,000 worth RSPs invested .I really dont have a retirement financial investor..She just an investor for my RSPs?Otherwise im on my own!!

My reg retire Pension has a Bridge Benefit is only good up to age 65 At $840 mnth…should I draw my CPP to supplement it age 65?or

draw my CPP earlier.

With my dental I have to pay 100% do you think its a good ideal to put money aside just for my dental work?

I have 60,000 in my RESPs what should I use this money for or is it just there to save for my funeral costs,emergency when im sick?

I enjoy triathlons racing $6000 year traving.Help!

Detailed, well written article. I’m 55 and planning ahead for retirement at 65. Getting educated on this topic is paramount.

Move to Lake Chapala, Mexico and enjoy life 365 days a year and forget all that bull kaka. If there is anything left when you croak… You made a mistake!

I love this article and your other articles. The ideals are always original and fresh. Do I have enough money to retire ? It is so hard to answer because we don’t know how long to live. Health and healthy life style is even more important.

Thanks for this article. I found it straightforward and readable except for the graphs which I will need to focus on a bit more.

Thanks for the kind words, Tina. I’m glad you found it useful for you.

This is a very thorough and well thought out article which can help to demystify and debunk some of the assumptions when planning for retirement. Its still up to the individual or couple to sit down and do some thinking about what they want to get out of retirement.

Some of the info will help me positively.

Using retirement income based on a percentage of employment income makes as much sense of basing your retirement income required as a percentage of unicorns to leprechauns.

At 4%, that 250k will generate 10k income and the CPP/OAS/GIS at age 65 will be approx 30k for a total of 40k/year.

Your spouse will be eligible for the allowance when you are 65.

For example if your only income is CPP of 13k, your GIS will be 418 and the allowance will also be 418. Including OAS of 590, your total OAS/GIS will be $1426/month.

See: https://www.canada.ca/en/services/benefits/publicpensions/cpp/old-age-security/payments.html

Keep your income as low as possible to maximize GIS/allowance benefits even if it means deferring withdrawals until they are required at age 71.

I wish some financial advisors would do a couple of scenarios for people that don’t have a million dollars. I would think, doing the right thing and when to do it, would be even more critical. We will only have about $250,000 and CPP. I will be near max. but my wife only $100 per month. I am 63 and her 61.

Thank you for this very good article. There is a strong need to debunk the pseudo-wisdom that too many so-called financial advisors keep parroting without understanding how incorrect and even damaging they are. So-called rules like the 70% replacement ratio are utter nonsense and must be demolished.

Very good article, Ed. I think with the CPP early withdrawal issue, it also depends on how much they have in the RRSP accounts. Drawing those down earlier while delaying CPP and OAS can have tax-saving benefits and having more guaranteed income later on, negating or reducing the reliance of investment returns.

Steve

Good article with lots of valid points. I wonder if these people have explored the idea of part time employment? Many companies will allow workers to take an extended leave of absence, sometimes on an annual basis. This can be good for the company if mentorship is important or even to mitigate the need for periodic lay-offs. It makes a certain amount of financial sense to go from $100K of earned income down to say 50K for 3 years instead of one & a half. If it’s a possibility, it has the more important advantage of easing into retirement as the change of lifestyle can be a bit of a shock. Now they would have some time to look after some “bucket List” items and still allow for the increased income when they fully retire. They mentioned 10K for travel. This way they could take a couple of big (and more expensive) trips while health and available energy is likely to be less of an issue than it might be a few years down the road. I like to think of transforming your lifestyle rather than a hard retirement date.

Required RRIF withdrawals soon surpass 3, 4 and 5%. What effect does this have on your ideas?

Particularly when the withdrawals result in OAS clawback?

Thanks

Very good article. Above average for sure. I am lucky that I know how to create spreadsheets to make these decisions. I am always surprised that these spreadsheets often do not support my “gut” feel and without them I would be making mistakes.

I tried to find a good financial planner a few times but was not successful. I think you will help a lot of people. A good financial planner needs to take the time to really understand all the details of their client and you have that ability, for sure.

John

Great article just proves we are on the right track. I retired last August at 61 and following a similar strategy as above, We are drawing at 5% thus living the dream and enjoying retirement!

Thanks for the great advice, I look forward to these articles!

Hi Todd Yourth,

Thanks for sharing. I love hearing retirement success stories.

YOur bridge benefit is intended to “integrate” your pension with CPP, so that starting CPP at 65 should roughly replace the reduction in your pension.

That does not mean you have to start it then, though. Your OAS already starts at 65. It is probably less that the pension reduction.

Whether you should take CPP early, at 65 or later depends on many factors. A Financial Plan can figure that out. There are 2 articles on my blog about it:

Should I start my CPP early? – Real-Life Examples https://edrempel.com/start-cpp-early-real-life-examples/

Should I Delay CPP & OAS Until Age 70? – Complete Answer with Real-Life Examples https://edrempel.com/delay-cpp-oas-age-70-complete-answer-real-life-examples/ .

If you have major dental work to do, saving up for it is a good idea. Make sure to pay for it all in one year to get a larger medical tax credit.

There are a few options for your RRSPs. You could take a small, sustainable amount out every month and enjoy the extra spending money. Or you could leave it for lump sum purchases or emergencies. You could leave them for your kids.

RRSPs are not the best for lump sum purchases. You can usually plan to withdraw them at lower tax brackets by taking smaller amounts ever year.

Possibly the best idea is to keep them and let them grow to cover possible retirement home costs. Once you cannot maintain your home, you may move to a retirement home. The nice ones can be quite expensive.

It is good to think through your options. Make a consious decision to live the way you want. Not to decide is to decide.

Triathalons at your age are cool. I don’t understand your comment, though.

Hope that is helpful, Todd.

Ed

Hi Sara,

Thanks for the kind words.

Ed

Hi Francis,

It’s called the “Die Broke” philosophy. If you can plan it right and not run out of money, it can maximize your retirement fun.

Ed

Great article with explanations and stats. Very useful for retirement planning.

Hi Siva,

Thanks for the kind words. I’m glad you found it useful.

Ed

Hi Tina,

Thanks for the kind words!

You don’t know how long you will live, so it is best to plan for the longer. The consequences of running out of money during your retirement are worse the consequences of having more money than you expected left when you pass on.

The general advice is to use life expectancy tables and pick the age that you or your spouse have no more than 25% chance of outliving. You may want to pick an even lower risk of running out of money. Note the reasons why John & Jen planned to have their money last until age 98.

The upside is that planning for to have your money last to age 100 usually means you only need to tak a bit less than planning for age 90. It is 10 years longer, but if you are, say, in your 60s when you plan it, the 10 years usually does not change your Retirement Plan by much.

Typicaly retiring one year earlier, say age 64 instead of 65, can have a bigger effect on your Retirement Plan than living 10 years longer from age 90 to 100.

I hope that is helpful for you, Tina

Ed

Thank you – a very comprehensive explanation of all those strategies I always hear tossed around. I am going to bookmark this!

Hi Marg,

Glad you found it useful!

Ed

If you can’t retire at 62 with a $1M nest egg you definitely have a poor plan. Collect your CPP as soon as you can. Live day to day and enjoy a frugal lifestyle. On average 7% return on investment and you should be good. Your likelihood of living to 92 or beyond is slim. This is where the B.S starts. What if?

Keep a cash float of $100 K to draw on so you can stay at a minimum tax bracket. Keeping a car that is paid for and not a big expense is a great idea. Plan your retirement with pencil to paper, why rely on strangers to give you the ‘most’ important advice of your life. Consider the equity you have as well, leave nothing behind other than your memory of enjoying life.

Hey rg…. Hi… I like what you are saying. Your comment is so dense (in a good way) that I was looking for some clarificaton. What does ‘Keep a cash float of $100K to draw on so you can stay at a minimum tax bracket’?

Right now I’ve got a truckload of money invested, 900G and about 15 in cash. I don’t have anything other than CPP coming in ‘new’. Haven’t started OAS but would you recommend that right away (65)?

I just need to bounce my thoughts off of someone and i’ll be damned if i’ll pay a financial advisor.

Thanks.

Art

the rote advice “leave CPP to age x advice is utterly misleading” – it depends A LOT on the number of years deducted off for non contribution – personally every year not taking CPP after age 60 would have resulted in DECREASING payout because I retired very early therefore had a large number of non-contribution years – everyone does NOT fit the same mould!

I have never yet seen a scenario whereby the net CPP decreases when you wait from age 60 to 65, and I can’t imagine how it might happen.

It’s certainly true that your average lifetime earnings might go down due to the extra zero-earning years and thereby your “calculated CPP retirement pension” would go down, but that is always more than offset by the increased percentage that you receive at age 65. I refer to this situation as waiting to receive a larger slice of a smaller pie, but you’ll always get more pie by waiting.

Hi Gordon,

Thanks for the kind words.

I agree completely. You still need to sit down and decide how you want to live your retirement. A Financial Plan can be a huge help. It is better to live intentionally and plan for what you want.

Glad it was helpful for you, Gordon.

Ed

Hi NoMoreBadAdvice,

Exactly. Using a rule of thumb to decide how much income you want to retire on presumes you are like everyone else. It is better to intentionally decide how much income you want and see whether you can create a Plan that will provide it.

I have prepared nearly 1,000 Financial Plans. In every case, the clients start by deciding the lifestyle they want.

The average is probably close to 70% of their preretirement income, but I have done plans with 45% and 150%. It depends entirely on what you want and what you can do by optimizing your financial resources.

Ed

Hi Gregg,

I agree. The need for a Financial Plan is not dependent on having a large amount of money.

In general, the larger your nest egg, the more options you potentially have available to you and the more complex a Financial Plan could be.

When you have more limited resources, it is more important to try to maximize or optimize your retirement income.

Size of portfolio is only one factor in complexity, though. Having a signficant non-taxable portfolio in TFSA or non-registered investments can give you all kinds of opportunities to plan your taxable income. Your taxable income can be far different from your cash income.

There are sometimes cool strategies, such as various strategies to get GIS at least for a few years that generally work more often for people with less income. The “8-Year GIS Manoeuvre” involves delaying CPP and converting your RRSP to RRIF, so that you can collect GIS for 8 years. It only works in certain situations.

Ed

Hi DM,

Excellent comment! I agree completely.

Ed

Hi Steve,

Whether or not to take CPP early depends on many factors, which I discuss in my article.

The very important issue usually missed is how you invest. It determines whether you are likely to gain more by allowing your investments to grow or allowing CPP to increase by waiting.

In general, equity investors should take CPP early, which balanced and income investors should delay CPP.

Ed

Hi Bill,

Easing into retirement reaching financial independence and then working part time doing only the parts you love is a great concept. I agree it is more wholesome than the traditional full-stop retirement.

There is a book about it called “Victory Lap Retirement” by Jonathan Chevreau & Mike Drak. I did a webinar and seminar with them on this topic last year.

Semi-retirement or a Victory Lap Retirement can be built into a Financial Plan.

Ed

Hi Rod,

Good question. RRIF withdrawal rates and the OAS clawback can all be planned for.

If you plan to withdraw 4%, but your RRIF withdrawal rate is 6%, you can either take less from a different account or reinvest the excess amount.

You can live your retirement with the lifestyle & withdrawals you plan for. The RRIF minimum withdrawals don’t have to mess you up.

Ed

Hi John,

Wow, thanks for the kind words.

I do find that people need financial planning advice much more than advice about investment A vs. investment B.

The financial planning industry is mostly just focused on investing. Investment-focused advisors always say the industry is very competitive. Being planning-focused, I find there is hardly any competition in Canada.

In 25 years, I have met very few Canadians that have a written financial plan they are following.

Ed

Are all the RRIF withdrawal rates the same for everybody? What are they?

My wife and I just applied today for CPP pension sharing, to lower our income tax payable. But it occurred to me, that she will now have to claim the increase as income, which might make her ineligible for GIS when she turns 65.Is that correct?

I am receiving under 1,000 and she gets 100. I am 63 she 61.

Hi Gregg – GIS for a couple is always based on your combined family income, so whether or not you share your CPP pensions will have absolutely no impact on her or your GIS entitlement.

Hi Dennis,

Glad you found it useful for you.

Your 5% withdrawal is likely sustainable if you have an equity focus. It is the yellow line in the graph above. 5% has worked about 80% of the time in history with a 100% equity portfolio and abouy 60% of the time with a 50/50 stocks/bonds allocation.

In my study, I ran simulations on many methods of managing retirement income, instead of just always increasing by inflation. I look at predfined rules on when to skip inflation incrases or reduce the income under certain conditions. There are also some academic methods.

I found that it is possible to have 100% success in history with 5% and even 6% withdrawals, if you manage your income effectively.

Ed

Hi RG,

Actually, living into your 90s is very common these days. In 50% of couples age 60 in Canada, one of them makes it to age 94. In 25% of couples age 60, one makes it to 98.

I should tell you my grandmother passed away in November. She was one month short of 109. That is rare, though!

The big risk in retirement is running out of money. It is best to plan for a bit longer than you expect to live.

Inflation will almost definitely at least triple the cost of living during your retirement (assuming 30 years).

Longevity and inflation are major factors.

I hope that is helpful for you.

Ed

Inflation rates in Canada were double digit 1980/81/82. Prior to that Canada experienced double digit inflation 1974/75 prior to that 1951. During retirement inflation is “not” going to impact someone nearly as what it did when you had higher income and substantially higher debt and payments. If inflation gets above 2% average and remains for a period beyond 2-3 years most retired people will need to honker down and ride out the storm. As for age in 2030 men will average 82 women 86. Possibility of living well into the 90s of course, not “highly” likely. I would speculate a $1.0 Million dollar nest egg with a withdrawl of 6% for the first 5 years and then a withdrawl of 4% for the remaining years should get 30 years of retirement income for fun. Hence my advice is know your own money and don’t rely on the experts to lead you astray.

Hi RG,

If you talk with seniors, many complain about being on a “fixed income”. High inflation would be a big problem for them. Even today’s low inflation means the cost of living roughly triples during retirement. It’s an important factor you need to plan for.

Living into your 90s is likely. In 50% of couples today, the one that lives the longest makes it to age 94.

Ed

Great article. I agree with most of it, but there has been significant research on the sequence of return risk and ways to mitigate it since it mostly occurs early in retirement. C Otar’s calculators at http://retirementoptimizer.com/ can quantify this risk and research from Pfau/Kitces https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2324930 shows that minimizing equity exposure early in retirement and increasing it as you age provides better outcomes (very non intuitive stuff). 3% withdrawal rates are always safer than 4% or 5% unless you annuitize the nest egg which is painful in this interest rate environment.

Hi Greg,

Great question, Greg! The difference between my study and those 2 studies is that I used actual data. The other 2 studies used theoretical data, which I believe seriously skews the results.

Both those studies use Monte Carlo simulations. They use statistics based on the mean and standard deviation of stock markets to create theoretical stock market returns, but that is very different from actual results.

For example, Monte Carlo simulations will look at a scenario where the 40% drop in 2008 happened 10 years in a row. I would submit to you that is impossible (given that our financial system still exists).

In reality, the biggest gains in the stock market are usually shortly after the biggest losses. It is the recovery. Stocks have consistently recovered in history, 88% of the time in 1 or 2 years. Howoever, with theoretical Monte Carlo, this reality is ignored.

In my opinion, the best and worst 5-10% of results in Monte Carlo analysis will never happen in real life.

Monte Carlo provides major issues with the results, because it is specifically the worst cases the study is focusing on. It is focusing on the 5-10% of times that the retirement plan failed – which I believe could not happen in real life.

It looks at the sequence of theoretical returns, which includes 10 market crashes in a row or it could include 10 technology bubbles in a row. In my opinion, Monte Carlo simulations are essentially useless in studying the sequence of returns.

In real life, the sequence of returns was only an issue once in the last 146 years – if you retired in 1929. With Monte Carlo theoretical returns, it would string multiple long bear markets in a row and show sequence of returns risk far higher than reality.

This theoretical data is fine if you are looking at market averages, but is seriously misleading when you are focused on the biggest gains and losses.

Monte Carlo simulations also miss correlations that often happen. For example, the biggest market booms often have higher inflation, while the biggest market crash had significant deflation. Monte Carlo simulations would look at all inflation levels with all markets, ignoring reality.

The Kitces study also uses very conservative theoretical future returns for stocks. It uses 5.5% after inflation for stock market returns, when the actual has been 8.59% after inflation (based on figures in the study).

My study is the actual history of 146 years of stock, bond and inflation. It shows what would have happened to real people doing these strategies each of the last 146 years. It is a far more accurate picture than any study using Monte Carlo simulations.

Ed

Thanks for the feedback. I appreciate the insight into Monte Carlo simulation relevance to retirement planning calcs. C Otar’s calculator does not use MC. “Aftcasting” creates many scenarios by starting retirement in many previous historical months up to 100 years ago and then calculates what would have happened over the next 30 years (much like your study) and computes how your asset mix and withdrawal rate would have done, so you can get an idea of how likely you plan will succeed.

Hi Greg,

Yes, you are right it is aftcasting. The link to Jim Otar’s page is essentially an ad for his calculator. I know him and saw a calculator he used 20 years ago, but I believe that was Monte Carlo simulations back then.

Have you seen studies by him? Are his results similar to my study?

Ed

Can someone tell me the minimum and maximum withdrawal rates when you transfer RRSP’s to an RRIF?

Hi Gregg,

The minimum withdrawal rates are here (use the bottom table): https://www.taxtips.ca/rrsp/rrif-minimum-withdrawal-factors.htm .

There is no maximum, unless you have a LIF or LRIF (from a pension).

Ed

Hi Gregg,

Don’t worry – GIS for a couple is based on family income.

GIS can be a big factor, but pension-splitting does not reduce it.

Ed

In my opinion this is the best article published on retirehappy. Even if I dont agree with each point it is thought provoking

Speaking of not agreeing; I built my plan, using today’s dollars on 10 year increments. More income for the early and active years, slightly less for the 70-80 years, and less still for 80+. Sure, healthcare costs may rise but I doubt we will want to be taking extended vacations in our 80’s.

As i said… thought provoking

Hi Bruce,

Wow. Thanks so much for your kind words.

Building a Retirement Plan with 2 or 3 different levels of income during retirement is a practical suggestion.

I have done some with a higher income level starting in the mid-80s under the assumption that they may be in a retirement home and would want a nice one (not a government home).

There is significant uncertainty on when your health may decline and make you less active. The big issue is travel, which often reduces in your 80s because the health insurance can get too expensive if you have health conditions.

My experience is that retirees with the money to travel tend to travel much later in life. Those without enough money often become less active sooner.

I agree. Thought-provoking.

Ed

Subject: General inquires

I need some clarity on the 4% rule.

I have been a useful investor for many years and have helped several friends with their investments. If one has a dividend + interest income of 3% of a portfolio ,according to the rule, one should reduce the capital by 1% to give a total of 4%.

This means , all things being equal, that the portfolio will probably increase over , say, 15 years.

So, should the 4% rule not read, withdraw 4% of capital and take the dividends + interest when paid out.

So in the present case an income of 7% would be possible.

There may be something suspect in this reasoning, I have queried a number of people , by email , about this , unfortunately I have never had reply

So what do you think??

ian

Hi Ian,

The 4% Rule is based on withdrawing 4% of your investments each year. Whether that is from selling shares or collecting dividends does not matter.

Withdrawing 4% plus a 3% dividend is a 7% withdrawal, which would have a relatively high failure rate.

There is a perception that dividends are income and capital gains are somehow different from dividends. However, both are supported by the growth of profits of the company. On the ex-dividend date, the shares drop in value by the amount of the dividend, similar to the way they would drop in value if the same amount was sold.

There is a tax difference between dividends and capital gains, though. Both have preferred tax rates, but different. Dividends usually mean you pay the tax far sooner than capital gains. That is the benefit of of “self-made dividends”. (https://edrempel.com/self-made-dividends-dividend-investing-perfected/ ).

Does that answer your question, Ian?

Ed

thanks Ed,

I am going to chew on this information for a while , do a few calculations , check on how quickly stocks rebound after ex dividend dates and come up with a plan to present to my friends. Personally, most of my portfolio represents NS,(NEVER SPEND) funds to be given away when I turn up my toes.

ian

Hi Ian,

The point is that dividends are not free. When they are paid out, they reduce the value of the company by the amount of the dividend. The total return of a stock is determined by the long-term profit growth.

In theory, at least, you have a choice, for example, of 10% growth with no dividend, or 8% growth with 2% dividend, or 7% growth with a 3% dividend.

Given a choice like this, the lower dividend generally results in lower tax and paying the tax years later.

Ed

The 4% rule is very arbitrary and maybe an overestimation if your portfolio principal gets above a certain amount. Four percent gets to be a large number if your portfolio gets above a certain amount. I wonder if you could rerun the graphs to use the 4% rule up until the point where the reduction gets up to say $100,000 – $125,000 and then cap it there. It is going to be a rare situation where a seventy-year-old needs more than $125,000 annually for his or her retirement. That would then leave more principal in the portfolio for reinvestment to grow the retirement fund such that you would not get into a position where you would run out of capital.

Hi Rob,

I looked at a variety of methods to manage retiremnt income, instead of simply increasing by inflation every year, to find ways to increase the success rate.

I didn’t consider capping the income, because that can vary based on the lifestyle you get used to. I have clients that find $40,000/year comfortable and others that find $250,000/year to be restricting. It all depends on lifestyle choices.

If you are surprised that people can spend $125,000, look at extensive or comfortable travel – or look at Leafs tickets!

I did find ways to take higher withdrawals, such as 5% or even 6%, with a 100% success in history by managing the retirement income with other methods.

These methods included only increasing by inflation when the withdrawal rate was below a certain level, reducing retirement income by 5% or 10% if the withdrawal rate gets too high, and I studied a few methods in academic articles.

You can get a very high success rate and not have to worry about running out of money without capping your income.

Ed

Hello Ed,

Great article, however, still trying to understand some of the theories. Do you provide personal advise if provided the facts?

I like how you have gone into depth on various scenarios and include 140+ years of research data. So having said this, I am interested in consulting with you on my, and my companions personal situation, outside of this forum.

At 57, I am in my 3rd year of retirement and live very comfortably (+100K annual). However, my companion is looking at retiring in 2018 and is very worried about her finances going forward. She will receive a small pension upon retirement, but has a substantial (details can be provided off forum) portfolio by which she can draw down on. She does not feel comfortable to draw down on her portfolio and requires some coaching, or more so, reassurance. We have consulted with 2 Financial Advisors from the “Big” banks, but none have the knowledge you demonstrate.

Hope we can retain your services and thus put our minds at ease and “Retire Happy”.

Hi Kimo,

Glad you enjoyed it.

I answer general questions here and on my blog, but detailed personal questions can really only be properly answered with a Financial Plan that looks at your entire picture. General advice on a specific question might be completely different when I understand your full finances and life goals.

I am a fee-for-service financial planner providing fully personal advice as a Financial Plan and with on-going Full Service. My services, the benefits and options are here: https://edrempel.com/become-a-client/ .

A Financial Plan and working and working with a knowledgeable professional can give you confidence in your future and security to know you will be okay.

When you are confident and feel secure, you can “Retire Happy”!

Ed

Not good with these things, so hope you can help.

I am 61 years old and currently retired and collecting a defined benefit pension plan (OMERS). I recently started a casual employment position that offers enrollment in the OPSEU defined benefit pension plan. Contributions would be 9.4% of earnings up to CPP earnings max, and 11% therafter (although I don’t think I will get into the 11% range seeing as how it is a casual position). I really don’t know how much I will end up making in a year.

I don’t know how long I will work…maybe a year or two or who knows…maybe as many as 10 years?? I still have young children in elementary and secondary school for at least 6.5 years, so no travelling style retirement for me at this point LOL!

Pension calculated like this:

Pension formula – the pension formula used to calculate your pension amount at age 65 is:

2% x best consecutive five-year average annual salary rate x years of pension service

minus

0.655% x the lesser of your best consecutive five-year average annual salary rate or the YMPE averaged over the final five years x your pension service (to a maximum of 35 years)

Survivor benefits: If you die after you have started receiving an OPTrust pension, under the current terms of the Plan, your eligible spouse or eligible child (for as long as the child is eligible) will receive a survivor pension based on 60% of the pension you were receiving when you died. If you die before age 65, you would be receiving a CPP bridge pension in addition to your retirement pension. The CPP bridge ends on the date you would have turned 65. On that date, your survivor’s pension is adjusted to 60% of what you (the member) would have received upon turning 65.

Eligible child is defined as:

Eligible child – under the current provisions of the OPSEU Pension Plan, a child is eligible to receive survivor benefits if there is no eligible spouse or if the eligible spouse has waived his or her right to receive survivor benefits and if the child is under the age of 18, or if over 18, the child is in continuous full-time attendance at a secondary school or, immediately following secondary school, is attending a postsecondary institution to a maximum of five years.

Should I join this pension plan?? Please explain why or why not. Understanding finances is NOT my strength!!

My wife thinks I should join. : ) She is 6 years younger than me, and as I mentioned, we have young school age children.

Thanks for your time and help!!

Hi Dadawell,

I see you have not quite mastered retirement yet! 🙂

Sorry to agree with your wife, but yes, you should join this pension.

I don’t know your full finances to say for sure for you, but this type of pension is usually fairly generous and beneficial to join.

The main reason is that your employer matches your contributions.

All those clauses are very standard for a government pension. Let me explain in over-simplified terms what you get with this pension:

– You pay in about 10% of your pay (withheld from your pay cheque).

– Your employer matches your contribution.

– Contributions are tax-deductible and use up your RRSP room, so think of it as an RRSP contribution.

– You get a “guaranteed” return of 5%/year. The guarantee is from your employer, which in your case is the government.

– If the investments makes more than 5% (normally the case), your employer can contribute less. If it makes less than 5%, your employer has to make it up. (This is done over a period of years.

– When you retire or quit, you can either transfer the value to your RRSP (except “locked-in”, meaning some restrictions on withdrawawls) or you can get a pension calculated based on the average life expectancy or a male your age.

– If your wife outlives you (likely) she gets 100% of what is left in your locked-in RRSP or 60% of the pension.

It is more complex, but this gives you a general idea of what a pension is.

The big benefit is that your employer matchees your contributions. Depending on how you invest, you can probably make a higher return than the 5% return you get from being in a pension, but starting with double the starting balance is hard to beat.

For example, if you make $50,000 salary, they may withhold $5,000/year. Your employer matches it and it grows by 5%. You have something like $10,500.

If you stayed out, invested the $5,000 yourself into an RRSP and made a 10% return, you would have only $5,500.

The amount you get at the end is determined by a complex actuarial formula, but this gives you an idea to estimate how much you might get.

Go tell your wife you agree with her!

I hope that’s helpful, Dadawell.

Ed

I would like to see more info for people who do not have company pensions to rely on, have to live in the “real” world where you have to scrimp to pay monthly living expenses and not always be able to save anything but minimal amounts. Trips – no $$ for that! Owning homes for equity? Haha! People who have worked hard at jobs that pay well but no pension try to save too and all this talk of having even a quarter million dollars to retire is a huge worry when there is nothing near that and you are in your 60’s. Advice for those folks is probably needed more than for those who have company pensions. Life is easy peasy if you have pension plans – anything else is just gravy – but it’s a world of difference if you haven’t been able to land one of those jobs. People with pension sometimes don’t sit back and be thankful of how EXTREMELY fortunate they are. Others don’t realize that having a quarter mill to retire is a fantasy to many, many people. Count your blessings if you aren’t in that boat because that boat is full of worry – something people with company pensions don’t understand.

Hi Deb,

People without a pension plan don’t need to worry. They just need a plan.

This article is about structuring your retirement income effectively and investing effectively so that you don’t have to worry.

Defined benefit pensions are nice, but mainly because they are a forced savings and the emplooyer matches your contributions. They take 10% off your pay, typically, and give you a 5%/year return.

If you don’t have a pension, you can still invest 10% of your pay and you shoudl be able to get considerably more than 5%/year long-term return. You don’t have the employer matching, so invest 15% of your pay and you can be as well off as anyone with a pension.

I admit it is hard for lower income people to save a lot. It also takes a lot of discipline, which can be hard.

If you are in your 60s and your investments are small, you can still plan for the best you can do. You can plan to know how much you can live on reliably. You might be able to plan to get more government benefits, such as GIS (which is based on taxable income).

Don’t worry about it – just plan.

Ed

Ed,

Do you have a link to the “8-Year GIS Manoeuvre” strategy?

I am thinking of scenarios, possibly a line of credit to maintain a certain level of income until I am forced to start RRSP withdrawls at 71. Unfortunately 95% of my retirement portfolio is in RRSP’s

Hi Max,

I have hesitated to write about this strategy, because I don’t want CRA to block it somehow. There are quite a few strategies to get GIS that I have kept low-key about and just used for my clients.

Now that you mention it, it would be a cool article. I could stick to the strategies that would be very difficult for CRA to block.

Living off a credit line for 8 years to collect GIS could work. It would have to be a home equity credit line to be large enough.

There are all kinds of possibilities that you can work out to see what works in your situation.

I include GIS strategies in Financial Plans I write, if you want me to look at your situation in detail to see what will work for you, Max.

Ed

Very informative article! It is always important to backup a theory by real data.

Speaking of running historical data, Bernstein wrote a few books on that. Not only did he speak of equity in general, he differentiated the risks and returns of different equity classes. “Rational Expectation” is my favourite. Of course it is unfair to compare an article to a book, and Ed already did a good job.

Interestingly, Bernstein has a different recommendation from Ed’s, even base on the same observation that equity has a better and perhaps safer return. Whether you like Bernstein’s idea to “quit the game when you won”, or continue with Ed’s idea buying into a financial planner, it is important to read and understand a bit more.

Just a humble opinion: beware of fees, including financial planner’s fee and the MER of the funds he/she recommends. A 2.5% fees will translate into 2-3% of annualised return. Plain vanilla ETFs are the best bet, I’d say.

Sam W.

Hi Sam,

Thanks for the kind words. Glad you found it useful for you.

I have not read Bernstein’s book. Looks like I should. Retirement is long-term – 30-40 years. I can’t understand why anyone would want to “quit the game when you won” if there are decades left.

I should add that the value of effective planning how to have the life you want, knowing the best way to achieve it, optimizing all your financial decisions and minimizing tax is very valuable. My fee is only 1%.

ETFs tend to significantly lag the indexes. The top global equity ETFs have a total tracking error of about 1%. Couch Potato investors lag by a lot more: https://edrempel.com/couch-potato-portfolios-vs-total-return-investing-graph/ .

I try to pay for myself entirely with above index investing. There are fund managers that beat the indexes. If you doubt it, read this: https://edrempel.com/will-never-etf-index-fund/ .

I also work with a portfolio manager that essentially only charges based on how much he beat his indexes.

My point is that real advice is worth paying for. And there are ways to beat the indexes.

Ed

I like how you have different opinions on mass accepted methods.

‘I found that it is possible to have 100% success in history with 5% and even 6% withdrawals, if you manage your income effectively.’

Can you provide the links on articles you’ve written on this? I’m interested in how you do this. Thanks!

Hi Laura,

Glad you found it useful.

How to effectively manage your withdrawals after you start to take them in retirement is an involved topic. I have a more detailed article on this that discusses some of the methods a bit here: https://edrempel.com/reliably-maximize-retirement-income-4-rule-safe/ .

Ed

I am 63 completed and my spouse (wife) completed 60. My last 4 years income is 0. We are residing in Canada since 2001. What pension benefits that we will get/

Hi Dash,

The pension benefits you receive will depend on how long you have been in Canada and how much you paid into CPP. OAS will depend how many years you have lived in Canada. You can get OAS and GIS when you turn 65, as well as the spouse Allowance for your wife, but you have to apply for GIS & the Allowance.

CPP will depend on how much you paid in from work over the years. You can start at any age between 60-70, but you have to apply.

Ed

Hello Ed,

Please help me to understand what would be my best option for retirement. My husband is 64 and already receiving his CPP of $250 a month. Hi will be eligible for OAS next year with 23 years of residency. I’ll retire in 6 years with 28 years of residency. I have $31,000 in RRSP and $160,000 in group RRSP (half of this can be unlocked when I retire) If I take CPP early I would be entitled to $377 a month starting next May. Would it be a good idea to take early CPP, take at 65 or defer until age of 70.

Also a question about melting down my RRSP as it’s going to affect my entitlement to GIS. What is the best option? I have just started TSFA with 20,000 in GIC as I don’t know anything about investing. Any suggestion is appreciated.

Thank you for your help.

The best option would be to defer your CPP to age 70 and let your RRSP portfolio grow until mandatory minimum withdrawals are required at age 72. Use your TFSA to supplement cash flow since it is not considered income. This would maximize your GIS entitlement until age 72.

You will receive a partial OAS but the GIS will be greater than those based on full OAS. See this article: https://retirehappy.ca/receiving-partial-oas-pension-affects-gis-amounts/

It would be great if you could do an article for people who want to retire early, like mid 40’s early. I can be a case study if you like as I am about pull the plug at 45. It’s a bit unnerving though, as there just is not a lot of good Canadian based information on FIRE.

Shouldn’t a 30 year retirement plan be broken down into three different plans, one for each decade? The spending needs of a 62 year old retiree are very different than that of a 88 year old. How many couples in their 80’s still own two cars and spend $10,000 a year on travel? The data clearly shows that as we age we spend less. https://www.i-orp.com/help/RealityRetirementPlanning.pdf I’ve witnessed this first hand with both my parents and my in-laws. Also, if they do want to retire early, another option would be that they would have to downsize their home at some point in the future, which is also very common for seniors to do.

I do believe that having at least one year and up to 3 years equivalent in cash is a good strategy to wait for the market to get back from a major crash. That being said, the cash should be invested into a high interest savings account and or short term GIC so it is readily available and so that you keep up to inflation.

I’m sorry but I completely disagree and don’t trust the stock market or any advisor, harsh,,yes, but I challenge anyone to really do a deep dive into their portfolio, and keep it simple, do not be guided by your advisor.

How much money did you put in?

How much money if you cashed out today “ or to be fair before COVID” do you have?

Figure out the net difference as a net gain or loss as a percentage and divide by years invested to get an annual return, The reality is a gut punch,

Or, test my theory pick any 10 year span in the TSX do the same then deduct The 2-3 percent fees, real return is only 3-4 percent in a stock market that has been on fire. Only to have you portfolio wiped out by COVID or 2008 or dot com,,,,,, but almost everyone will not even keep up with the TSX because to build “safety” they will mix in bonds, bonds don’t pay enough to cover the fees being charged by the advisor, bank, and firms involved.

Ask yourself on $1m portfolio paying $20-$30k in fees a year whether your up or down, do you see value?

This is a rough starting point to open your eyes and ask questions, I really advise looking up David Trahair’s books and on this site, For a detailed plan for retirement.

Until you do the work yourself and know what you are doing now is not working you can’t give yourself power to take control.

#1 rule of money, if YOU don’t understand 110% what you are invested in, why you made the decision to invest in it, exactly what your return is, and what the risks are, don’t invest it.

Unpopularly yours

What you will find is the stock market and advisors are

Why does the portfolio survivability decrease slightly at 100% equities compared to 80% equities? Does that suggest that holding a small amount of bonds is a better option?

I am 66 years old. I am not eligible for OAS because my stay in Canada is less than 10 years.

I left Canada in 2014 for overseas, at that time my stay in Canada was 7 years and 10 months.

I returned to Canada in September 2018. To complete 10 complete years of stay in Canada, how much more period (Three years or Two years and two months) I have to live here.

Please advise and suggest.

Hi Akhtar – If your first period of residence was 7 years and 10 months, you would complete your 10 years after a further 2 years and 2 months.