Teaching kids to save with a piggy bank

There are lots of different strategies to teach kids to save money but the classic icon for saving money is the pink piggy bank.

I started to teach my kids about money and saving at the age of 2. Every child got a piggy bank and $3.41 which is a Twoonie, Loonie, quarter, dime, nickel and a penny.

If you think about it, the pink piggy bank is a great icon for savings because when you give a two year old a piggy bank and coins, what is their natural instinct? They immediately pick up the coins and put it into the slot at the top of the piggy bank. Once they are out of coins, do you know what their next natural instinct is? Try to figure out how to get the coins out which may be symbolic of spending. The cool thing about the piggy bank is you can’t get the money out which may be symbolic of forced saving for the longer term.

Related article: Pay yourself first

Some people preach the use of money jars but the problem with jars is the easy access to money. I think jars are a better representation of saving to spend which is different than saving for the financial future. Both have a role.

Start pay yourself first early

Recently, I received an amazing gift from my friends at Financial Services Group. Scott Kwasnechka sent each of my boys a personalized ceramic piggy bank with $3.41 cents in each of the piggy banks. Needless to say, my boys were pretty excited and wanted to fill the piggy banks up as I have taught them. Piggy banks are a great tool to teach kids how to save.

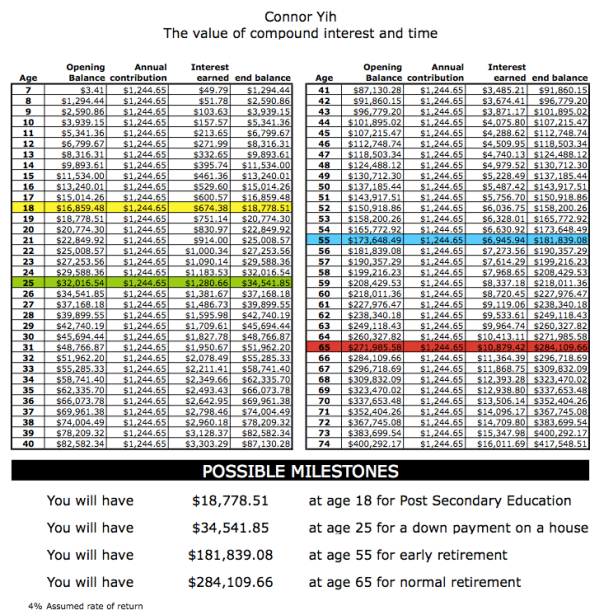

What was more interesting to me (and most parents) was the laminated sheet that came with the piggy banks that showed the future value of $3.41 invested daily.

As you can see, saving $3.41 per day can really create some great opportunities for the future when it comes to funding education, buying a home or even for retirement. I think this is an amazing way to create awareness, not only for kids but according to Scott Kwasnechka, “The piggy banks seem to have a greater impact on the parents. It’s the parents that really buy into the idea of putting money away for the kids starting as soon as possible”

The benefit of starting early

In comparing the 4 spreadsheets created for my boys, I was reminded about the importance of starting early.

| Milestones | Starting at age 3 | Starting at age 5 | Starting at age 7 | Starting at age 8 |

| Age 18 – Education | $27,253.56 | $22,849.92 | $18,778.51 | $16,859.48 |

| Age 25 – Buy a Home | $45,694.44 | $39,899.55 | $34,541.85 | $32,016.54 |

| Age 55 – Early Retirement | $218,011.36 | $199,216.23 | $181,839.08 | $173,648.49 |

| Age 65 – Normal Retirement | $337,653.48 | $309,832.09 | $284,109.66 | $271,985.58 |

The difference between starting at 3 years of age versus starting at 8 years of age is significant at all milestones.

Related article: Start Saving early early

The biggest enemy of saving is procrastination. Don’t wait and get started sooner than later.

Saving a little more each day

American Best Selling author, David Bach, popularized the Latte factor which is simply a term that suggests cutting back spending so that you could save $5 per day. Can you think of something in your life where you could be able to cut out spending of $5.00 per day? What if we were to put away $5.00 per day instead of $3.41 per day?

| Milestones starting at age 3 | $3.41 per day | $5.00 per day |

| Age 18 – Education | $27,253.56 | $39,961.24 |

| Age 25 – Buy a Home | $45,694.44 | $67,000.65 |

| Age 55 – Early Retirement | $218,011.36 | $319,664.76 |

| Age 65 – Normal Retirement | $337,653.48 | $495,093.07 |

Even a $1.59 per day makes a significant difference over time

Related article: The Latte Factor

Teaching kids to save with a piggy bank can be a very powerful lesson because developing the habit to savemoney is one of the keys to financial success and the best way to develop the habit is to start as early as possible.

Comments

Great article Jim! Awesome to hear the boys are enjoying their piggy banks and saving for the future!!

Good Morning Jim,it is so inspiring to see others feel the way we do @ FSG. Kids have commitment and this is the key factor once we have the coins and the piggy bank.

Continue to enjoy this boys.

Excellent article!

The Piggy Bank for the 21st Century:

The Award Winning Money Savvy Pig

Glad you covered the importance of starting early Jim. I have always been fond of calculations, especially when it comes to finding the amount of money I could potentially get later by cutting down on unnecessary expenses and becoming an early saver. I will make sure my kids learn the same virtues and start to save from an early save as well.

This is a genius idea! I’ve given my kids money to save and sometimes when I’m tight on cash they offer their little bit of money to help me out. it’s cute, but I obviously don’t accept it. I’ve been surprised by how much my 12 year old has saved up (nearly $200). It’s good to see our saving habits passing on to our kids. I use this tactic to teach my kids the importance of money, that way they understand that when mommy doesn’t have money, mommy REALLY doesn’t have money to spend on useless junk. I’m going to get my little ones a piggy bank. Not sure they will stay saving their money until they are well into their 20s though.

I am always happy to see a blog about improving the financial literacy of our children. You have done a great job of simplifying the benefits of saving and the rewards that are reaped by starting early. It is pretty hard to ignore when when it is spelled out like this in black and white.

Love it! I agree, piggybanks are better than jars because they are unwieldy and create too much temptation with seeing all that money sitting around. Even better if it’s hard to get into the piggybank.

Can I make an alternative suggestion? In this day and age it’s easy to make an “online” piggybank by opening an account for your kids under your existing online banking account. Takes about 30 seconds.

My kids make $1 for various chores and record it on a job sheet. Every once in a while, I pay out the little ticks on their job sheet by transferring funds from my account into their designated account. They love seeing the totals climb. (They also like my 10% bonus on every $100 saved.)

When they get birthday money or Xmas money they don’t use right away, they “deposit” it with me and I transfer more funds into their accounts. They end up saving about 50-90% of their money this way. Out of sight, out of mind.

Wow this really demonstrates compound interested and how powerful it is. Once I start a family I am going to ensure that I start saving some of my income for their future. $5 a day from birth will easily cover their education for life!

What is the CRA’s take in these scenarios??