Canada tax brackets: Marginal tax vs average tax

Updated for 2024

In Canada, we operate under a marginal tax rate system which simply means the more money we make, the more tax we are privileged to pay. Marginal tax is simply the amount of tax paid on an additional dollar of income. As income rises, so does the tax rate. This is different than a flat tax rate where you pay the same rate of tax no matter what your income level is.

Knowing your marginal tax rate can help you make effective financial decisions. From a planning point of view, it is not good enough to just know how much money you make. It is essential to understand how much you keep. Making a dollar doesn’t allow you to count on spending that dollar. Knowing your marginal tax rate will tell you how much of that dollar you can utilize toward your lifestyle. If you are planning your finances or retirement, the focus should be on your net income.

Canadian and provincial tax brackets

In Canada we have two layers of income tax – federal and provincial. To illustrate how marginal tax rates work, my example shows tax rates for Alberta residents and encompasses both provincial and federal tax.

For the year 2024, there are many tax brackets:

Alberta Marginal Tax

| Lower Limit | Upper Limit | Marginal Tax Rate |

|---|---|---|

| $0 | $15,705 | 0% |

| $15,706 | $21,885 | 15.0% |

| $21,886 | $55,867 | 25.0% |

| $55,868 | $111,733 | 30.5% |

| $111,734 | $148,269 | 36.0% |

| $148,270 | $173,205 | 38.0% |

| $173,205 | $177,922 | 41.32% |

| $177,923 | $237,230 | 42.32% |

| $237,231 | $246,752 | 43.32% |

| $246,753 | $355,845 | 47.0% |

| $355,846 | 48.0% |

If you earn $60,000 in income, then you would be in the 30.5% marginal tax bracket and you would pay 30.5% of any additional dollar you made to the federal government. If you earn $120,000, then you would be in the 36% marginal tax bracket.

- DOWNLOAD 2024 TAX RATE CARD

- DOWNLOAD 2023 TAX RATE CARD

- DOWNLOAD 2022 TAX RATE CARD

- DOWNLOAD 2021 TAX RATE CARD

- DOWNLOAD 2020 TAX RATE CARD

- DOWNLOAD 2019 TAX RATE CARD

- DOWNLOAD 2018 TAX RATE CARD

- DOWNLOAD 2017 TAX RATE CARD

One of the biggest misconceptions about tax rates is that your entire income will be taxed at your marginal tax rate. Here’s an example to show you how it actually works:

The person making $60,000 per year would not pay $18,300 in tax ($60,000 x 30.5%). Instead, his/her tax would be calculated like this:

$15,705 at 0% = $0

($21,885 minus $15,705) at 15.0% = $927.00

($55,867 minus $21,885) at 25.0% = $8,495.50

($60,000 minus $55,867) at 30.5% = $1,260.57

Total tax = $10,683.07

The marginal tax rate of 30.5% is the amount of tax paid on any additional dollar made up to the next tax bracket. In this example, the average tax is only 17.8% ($10,683.07 divided by $60,000 of total income). Average tax is the percentage of tax paid based on your total gross income and reflects the total tax you are paying. It is the total amount of tax you will pay through all the brackets divided by total income and will mathematically always be lower than the marginal tax rate.

The tax system varies from province to province. With 10 provinces and 3 territories, you can imagine the complexity of the Canadian tax system. Add in the fact that the rules can change every year because of provincial and federal budgets and you have an ever-changing and complex tax system.

Tax calculator

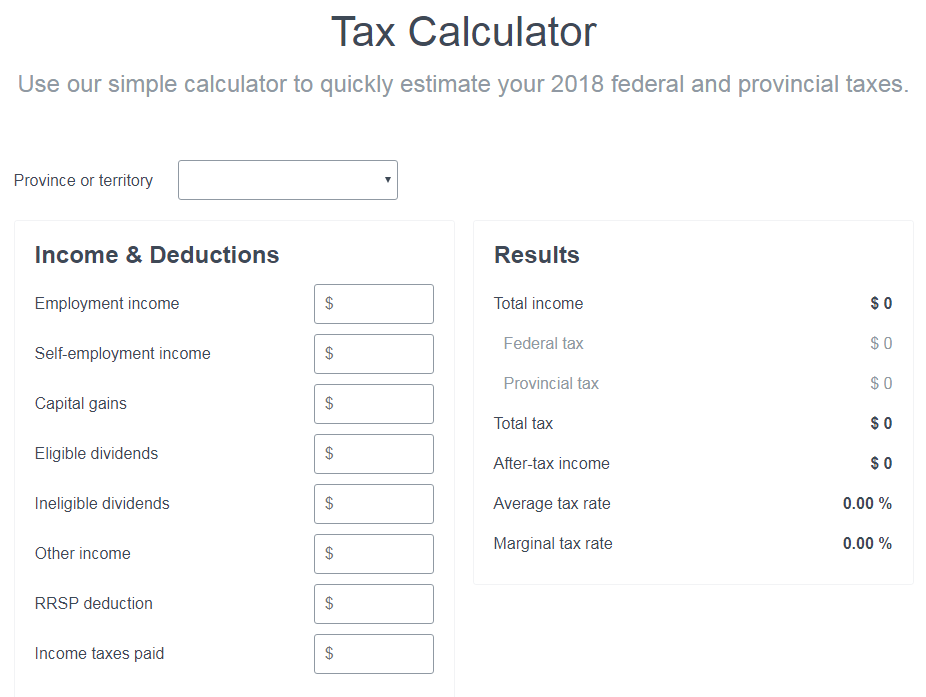

There are a lot of tax calculators online. Some are complex and detailed. The one tax calculator I like to use often is super simple and free by Wealthsimple. They also offer completely free tax software, aptly titled Wealthsimple Tax.

Here’s a quick screenshot of the calculator:

Pay more tax, not less tax

Lastly, paying tax is not such a bad thing because it means you are making more money. You hear people complain about paying tax and the desire to pay no tax. I have a solution . . . make no money and you will pay no tax.

But also know that no matter what tax bracket you are in, you should never ever turn down money. Our tax system works in such a way that the more you make, the more tax you will pay but you will still always win by making more money. You will never lose by making more money. Someone making $350,000 per year will pay more tax than someone making $250,000 or $100,000 or $50,000 but they will also take home more money after paying tax at the higher rates. Ironically, your goal should be to pay as much tax as possible by making more gross income in higher marginal tax brackets.

My advice to people. Learn how the tax system works before you complain. Learn how to use the system to your advantage. Spend more time on tax planning than investment planning and trying to predict the future of the markets. That’s time better spent!

Comments

For a while now, I have been wondering why no politician from either party has proposed establishing additional marginal tax rates above the much argued $250k threshold.

Could you explain how the Ontario Surtax and Health premium are added to the marginal tax rate? For example, at $130,000 taxable income, the marginal tax rate is listed as 46.4. I understand that the Federal tax is 29% and the Provincial tax is 11.16 = 40.16. How do you get the other 6.24% to make up 46.4?

There is only one part of the article that is wrong. That first bracket is not taxed @ $0. It is taxed at 15% x basic personal exemption at the minimum. Is this correct?

Not exactly, no. The basic personal amount reduces your taxable income by $13,808 (2021). So if you earn $15k, your taxable income would be reduced to $1,192 and your federal tax owing would be $178.80 instead of $2,250. In other words, the basic personal amount reduces your effective federal tax rate on the first $13,808 you earn to 0%.

Andrew, curious if you know the basics around this. one… will getting up to date on your RRSP contribution room (e.g. $100K) result in a good enough refund, i.e. go back into the prior years of taxes paid, e.g.. paying $10K every year? I am trying to get a better understanding, without a financial planner, at this point. It’s really about the taxes paid already versus taxes to be paid.

Your last bracket (for the $100,000 earner) in Ontario is wrong. The calculation is calculated over the entire bracket and not for the difference between the lower bracket and $100,000. As a result the table suggests that someone making $100,000 in Ontario makes more than a similar individual in Quebec. As a Quebec resident, I could see immediately that this had to be mistaken. In fact an Ontario resident pays about $6000 less.

Sad but true:

You CAN lose by making more money!

In 1970s socialist Sweden a well known author had a 102% marginal tax rate!

https://en.m.wikipedia.org/wiki/Pomperipossa_in_Monismania

Personally I think Quebec’s top bracket is over the top.

Great article, Jim. You’re right, paying tax is not a bad thing. A lot of people are happy to receive a tax refund. You shouldn’t be so happy when you realize you’ve been giving the government an interest-free loan. Owing taxes is better, as long as you put money aside during the year.

Agreed. It’s what I have always done. And, it helps to build the skills of financial literacy and budgeting.

I have nothing against paying taxes either. Ditto for “Employment” insurance, CPP/QPP, welfare and many other wealth distribution policies of the governement.

What most people complain about is the visible WASTE of our money (yes it is our money, not the government(s). After all, is the government not by and for the people). If our money was managed correctly and wisely we would have little or no governemnt debt and maybe consequently less tax(es). How much money has been skimmed off the top on contracts to help along the sales process and ensure such and such a company gets the contract. Why is it that families on welfare (remember I am not against welfare) can not have even one working member after three generations? And so on.

Administer the funds correctly and we will hear only from the bleeters who are not happy with anything – except living off the dole.

RICARDO

Your tax brackets are wrong. http://www.cra-arc.gc.ca/tx/ndvdls/fq/txrts-eng.html

Grace, His tax brackets are for both Federal and Provincial tax combined, that is why it is different from the brackets listed in your link.

I must be doing something wrong or in error. Just did taxes for 2016, live in Ontario and marginal tax rate was 53%

I want to know why income is taxed at a rate of 25% if you reside out of the country.

Jim: I love your article and they are all so clear helpful and easy to understand.

Thank you so much.

In your example of the Alberta resident who made $50,000 and his total taxes owing were 8883.10. Then why does the Simple tax calculator say he owes $11,086.

The Simple Tax calculator includes CPP/EI into their average tax rate calculation. Is that a correct variable to add in that?

If you put the income into other income, it will not include payroll deductions like CPP and EI.

Why does the government kept increasing baby/children benefits to families who are on welfare. This will encourage these parents to keep having more and more children, and not to acquire any employment. This will also encourage generations of the same family to continue the trend of living on tax payers’ money. Hence, this will drive the country’s debt higher and higher, hence, taxes as well. I am not against baby bonus, but it should be calculate in such a way that will encourage at least one parent to seek employment. I was a single Parent of one child, with no family support in this country, and I have always worked.

I wonder if the OAS clawback could lead to less income by earning more?

Does this apply to business taxes as well? Do you calculate your marginal tax rate based on your net profit and then subtract those percentages based on your write offs?

You seem to have more tax brackets than when I file my taxes

I seemed to recall that 49020 was the upper limit at 15%

and 98000 was the upper limit for 25%

He is showing the marginal tax rates for Alberta residents. Someone earning $49,020 will pay 15% federal and 10% provincial tax, resulting in a marginal tax rate of 25% on that level of income.

Jim let’s I made $50000.00 in income but $20000.00 of that is capital gains. Should I assume that I would still be in the 30.5 tax bracket however that $20000.00 would only be taxed at $15.25 since capital gains are taxed at 50% of earned income? I just want to make sure I am understanding correctly.

Something I am missing with these calculators is the ability to see the impact of the age amount and pension income credits. They make a difference at moderate pension income levels. An example with 2021 tax rates: 50K at age 64 results in tax of $8257 (average tax rate = 16.5%). 50K (from a pension or RRIF) at 65 results in tax of $6786 (average tax rate = 13.4%). That’s almost $1500/year in tax savings.

If I need a yearly take home income of $56100.00, how much would I have to pay on top of that in Alberta for taxes when I retire

I found an easier-to-use tax calculator at https://www.consolidatedcreditcanada.ca/calculators/income-tax-calculator/ it not only calculates federal and provincial taxes owed but also compares the amount owed across provinces

I use a CRA approved tax software to figure out the scenarios. No guessing. It takes into account being married, which some calculators don’t use. Especially after age 65 a RRIF or a LIF can become split income. The software optimizes the splitting according to form T1032.

I can figure what taxes we pay.

Been using the same software since 2013 and since I retired in 2022 I was able to plan how much to take out of my RRIF. Only drawback for myself was that I could not foresee what taxes I would pay before I actually reached age 65; got to use SIN and I couldn’t fool it for my age.

Even if you have someone else filing your tax return, why not just give it a try just to see if you come up with the same amounts. The software I’m using is free until you file an actual report. Which you wouldn’t file in this situation.