Why I chose Justwealth for my family’s RESP

Background on Robo-Advisors

Robo-Advisors in Canada has come a long way. They are growing in popularity. I get more and more people asking about them and whether they are any good. You see more advertisements on the web and more and more experts are preaching the merits of Robo-Advisors. All that being said, they still have a long way to go. I still meet more people that have never heard of Robo-advisors than people who have. The business requires some level of scale to be profitable so long term, Robo-Advisor firms need to get to those levels for long term sustainability.

Related article: Key things you need to know about Robo-Advisors

I have done a lot of research on Robo-Advisors and Robo-firms and I love the idea and concept. I don’t think they are for everyone but I think they are a good fit for a lot of people. Specifically, I think they are ideal for those people that are disillusioned with full-service advisors and paying high fees for not so superior services. At the same time, I meet a lot of these people who are tired of paying big fees but not quite comfortable or confident or passionate about the idea of becoming a do-it-yourself investor. Robo-Advisors could be the perfect “halfway” fit in for these investors.

Related article: Battle for the best Robo-Advisors in Canada

For me personally, I continue to invest my RRSPs at Questrade in passive, low-cost ETFs. I thought about moving my RRSPs to a Robo-Advisor but you can’t get the fees down much lower than what I have with my RRSP portfolio so I decided to leave it there in a portfolio of ETFs.

Background on my RESPs

Next to my RRSP, my RESP has grown to become a very significant investment portfolio. I’ve been putting money into RESPs since 2003 when my first son was born. Every year, I continue to contribute to the RESPs to take advantage of the Canada Education Savings Grant. RESPs are a great way to save for kids’ education and now with 4 boys, I contribute more into the RESPs than I do into TFSAs.

Related article: RESP contribution rules

My RESPs were the last account that remained in higher-fee mutual funds so I thought I would move that account to Robo-Advisors to reduce fees but also personally experience Robo-Advisors.

One of the biggest attraction to Robo-Advisors is the low fees especially compared to high fee mutual funds. I started my RESP with Trimark back in 2003. The MERs I was paying through Trimark (no Investco) were in the range of 2.25 to 2.5%. Robo Advisors charge about 0.5% to invest money. That’s a big difference. It’s important to note that the Robo-Advisor fees are in addition to the Management Expense Ratios of the underlying investments (ETFs) which will typically be under 0.5%. In terms of fees, here’s what I found when I looked at my RESP options:

- WealthSimple and Nest Wealth had the best deal at a 0.4% fee.

- Everyone else was at 0.5%

- Wealthbar came in the highest at 0.55%

Opened my RESP at Justwealth

My cynical view of all the Robo-Advisors is that they are all much the same. When I looked at the cost of Justwealth, their fees were in the pack at 0.5% along with everyone else. When I looked at the Justwealth website, their top reasons for choosing Justwealth included:

- Investment expertise and innovation

- Commitment to clients

- personal portfolio management

- cost-effective solutions

- online convenience

- safety and security.

Honestly, you could go to any of the competing Robo-Advisors and find this same list on all websites. So why did I choose Justwealth? The big differentiator for me was their Target Date Portfolios for RESP accounts. I liked the idea that the portfolio would adjust risk as my children got closer and closer to their post-secondary education.

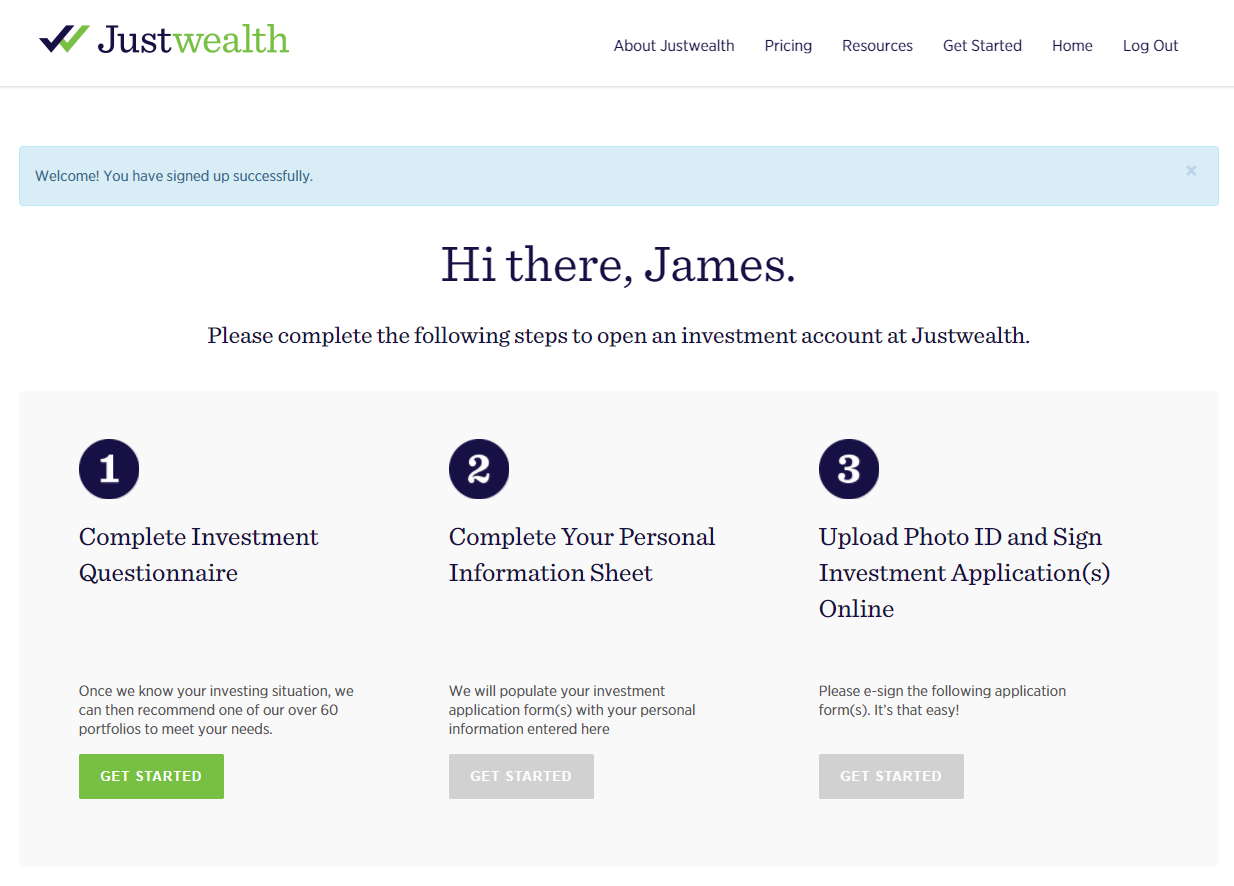

Opening an account at Justwealth was intuitive and the service from their team was exceptional (especially Isobel). I started the process online with 3 steps:

- The investment questionnaire

- The information sheet

- Identity verification

Once that was done, I received an email back with clear instructions and if I needed help along the way, Isobel was there to answer questions and help out. One example was dealing with a family RESP plan with 4 kids and allocating the right amount to each of the kids because I wanted different amounts to go to different children (I like some of my kids more than others). I really have nothing bad to say about the service I got from Justwealth.

When it came down to investing, I even got a personal phone call from James Gauthier to review how the Target Date investments would work.

The service update

I first opened my Justwealth RESP in December of 2017 so I’ve had my account there for over 1 year. I don’t have much interaction with them other than I will log into the website and look at the account from time to time. Like most people, I log in to see how much money I have, whether the Canada Education Savings Grant (CESG) has been deposited and also how the portfolio has done. The returns are what they are supposed to be when investing in passive ETFs.

If I had to do it again, I would definitely choose Justwealth.

If you are interested in Justwealth, they have kindly offered RetireHappy readers a bonus of up to $500 if you open up a new Justwealth account.

Comments

I like that you put your own money into this product, so you’re giving it a true ‘road test’. I hope we hear back from you from time to time, to see if it’s meeting your investment goals. I like your articles because they’re practical and well explained. We’ve tried one robo-advisor account in our family and it’s still too early to tell how it’s doing, long-term, compared to our other self-directed accounts. The ‘target date” concept you’re using at JustWealth for the RESP sounds like it would work just as well with RRSP’s.

We went the discount brokerage route for our famIly’s RESP. Held mainly TSE 60 individual stocks: Banks, Energy, Utilities, Telcos, and the odd Consumer Staples stock like George Weston. At $9.95 per trade (in and out) and around 10 stocks held over the life of the plan, I suppose I spent about $199 in commissions all told. Occasionally I reinvested dividends to buy more of the stocks I already held, so perhaps spent another $99 on commissions doing that. All three kids got a college education, and there was money returned to us when we closed down the plan in 2017.

A Self-directed brokerage account is a another good RESP option if you can tolerate some risk and are willing to learn how to select good companies to invest in. The fees for our RESP, based on amount invested, were about one-third of a percent.