New income tax rates in Alberta

In 2015, Albertans went to the polls twice. Once to vote for a premier of our province and then for a Prime Minister. In both cases, the Conservatives went down. Provincially, orange became the new Blue as the New Democrat Party swept the province in convincing fashion. Federally, The Liberals won a majority government and Justin Trudeau became our 29th Prime Minister.

Both parties were very vocal about their fiscal platforms and the fact that they wanted to raise income taxes especially for higher income earners. In my 25 years in the financial industry, the one consistent message I heard from people was that they hated paying income taxes but obviously the vote for change was pretty powerful.

The change in income tax structure for Albertans is pretty significant so here’s a review of income taxes in Alberta – past, present and future.

Understanding Marginal Tax

If you are not sure about how the Marginal Tax Rate system works in Canada, you should review the difference between Marginal Tax and Average Tax

The past

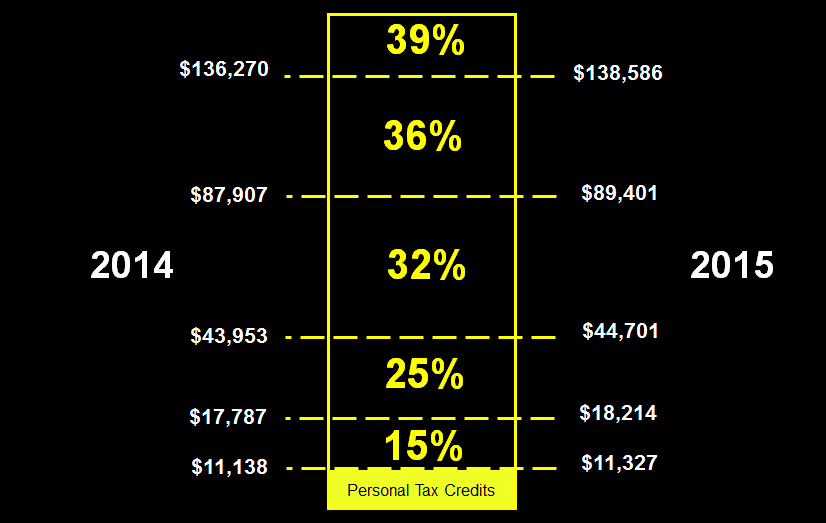

Prior to the new provincial and Federal Government in Alberta, here’s how the Marginal Tax rates looked for Albertans in 2014 and 2015:

The present

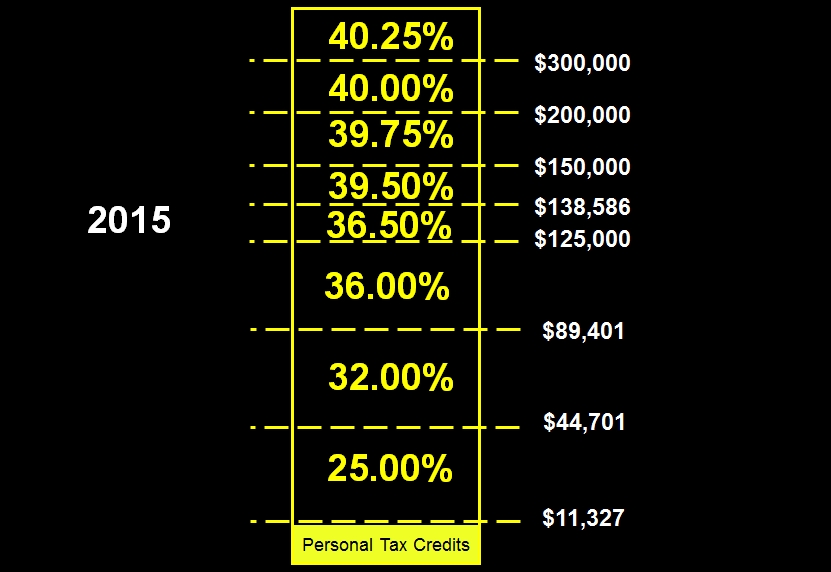

As of October 1, 2015, the Provincial NDP Government moved away from a flat tax to a progressive tax system where higher income earners would pay more. As of October 1, 2015, they introduced a 5 bracket tax system where individuals making less than $125,000 per year will still be taxed at 10% but if you make more, the tax will increase. Here’s the new income tax rates in Alberta:

| Income |

Marginal Tax Rate (Alberta) |

| less than $125,000 |

10.00% |

| $125,000 to $150,000 |

10.50% |

| $150,000 to $200,000 |

10.75% |

| $200,000 to $300,000 |

11.00% |

| $300,000 and over |

11.25% |

The end result, when you combine Federal and Provincial income tax, looks like this:

What does the new income tax rates in Alberta mean financially? The bottom line is that Albertans who make less than $125,000 per year will not be affected one way or another. Anyone making more than $125,000 per year will pay more.

The Future

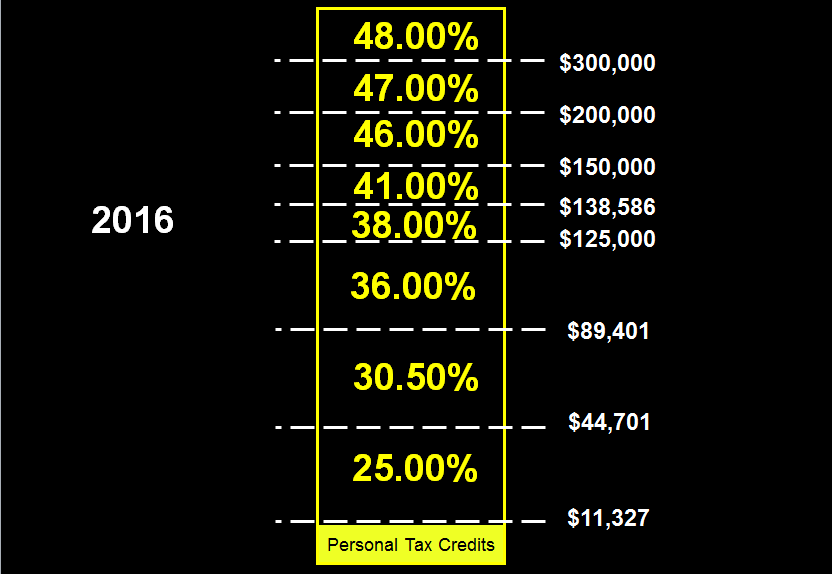

In 2016, some Albertans get hit with a double whammy! Provincial tax rates over $125,000 of income are going up significantly:

| Income | Marginal Tax Rate (Alberta) |

| less than $125,000 | 10.00% |

| $125,000 to $150,000 | 12.00% |

| $150,000 to $200,000 | 13.00% |

| $200,000 to $300,000 | 14.00% |

| $300,000 and over | 15.00% |

In addition to these tax hikes by the provincial NDP, the new Federal government also plans on sticking to it’s election platform of raising taxes on the highest tax bracket from 29% to 33% but lower taxes in the middle bracket ($44,701 to $89,401) from 32% to 30.5%

Here’s what the end result will look like for Albertans:

What does this mean to Albertans?

|

Past

|

Present

|

Future

|

|||

|

Income

|

Total Tax

|

Average Tax

|

2015

|

2016

|

Average Tax

|

|

$90,000

|

$21,141

|

23.5%

|

no change

|

-$671

|

22.7%

|

|

$100,000

|

$24,741

|

24.7%

|

no change

|

-$671

|

24.1%

|

|

$125,000

|

$33,741

|

27.0%

|

no change

|

-$671

|

26.5%

|

|

$150,000

|

$43,084

|

28.7%

|

$125

|

-$296

|

28.5%

|

|

$200,000

|

$62,584

|

31.3%

|

$500

|

$2,830

|

32.7%

|

|

$300,000

|

$101,584

|

33.9%

|

$1,500

|

$9,830

|

37.1%

|

Comments

An interesting posting. Perhaps I am missing something, but putting the three charts side by side, the biggest jump (from 15% to 25% = a 67% increase) for any category seems to be for folks earning between $18,214 and $44,701. Those ranging between $9.10 an hour, to $22.35 an hour. Not sure about Alberta, but in Canada generally that is a significant number of workers … It’s old data, but the Financial Post reported, “Of the 24.5 million returns filed (for 2009), 18 million Canadians reported total income of $50,000 or less. That’s not a typo. In other words, ignoring individuals who don’t file returns such as children, nearly 75% of tax-filing Canadians earned under $50,000 in total income in 2009.”

That means a large number of Canadians would see a significant increase in the tax they paid if their tax rate increased from 15% to 25%. One might argue that since this group has far less disposable income (living paycheque to paycheque) the difference they’d face would be more extreme than an increase in tax rate for those earning in the high brackets. Oh, true, the high bracket payers would see their actual dollars paid increase more, but the percentage change in discretionary income might actually be less for the large wage earners than the minimum wage earners.

Am I missing something?

Hi,

Does this mean your taxed at the highest tax bracket your in? Or on the first 125,000 your still taxed at the lower rates then anything above that your taxed at the higher rates ?

Hi Ricky, other than paying them for 50 years I’m no expert. You only pay on taxable income the rate where it falls, i.e. for $100K the first $44701 would be at 25%, the remainder would be at 30.5% to $89401 with last $11599 at 36%. The personal exemption does not change federally, but that is deducted from your taxable income as are any other any other qualifying deduction, eg. pension, professional dues, medical expenses(to a limit), RRSP contributions etc. Provinces set their own personal exemption for the provincial portion and can range from $9300 or so in NS (recently raised to $13000 or so) to north of $18000 in AB. Looked at one way, you can earn this much and not pay provincial tax at all, basically it decreases your taxable income by this much. The accompanying chart does not break it down this way and uses combined Federal and Provincial rates. Sounds confusing because it is. You actually have to calculate the Fed and Prov. rates separately and according to your own situation to have it make sense to you. Hope that helps