Differences between LIRAs and RRSPs

In dealing with Workplace Savings Programs, there can be a lot of confusion with the difference acronyms in the financial industry. One of the common misunderstandings is knowing the difference between LIRAs and RRSPs.

What is an RRSP?

RRSPs are very common. As a result most people have heard of them, know something about RRSPs or have contributed money to an RRSP. There is lots of information on RRSPs so here’s a quick summary:

The RRSP is a tax sheltered savings plan designed to help Canadians save for retirement. Contributions to a RRSP are voluntary and subject to contribution limits. When you contribute to a RRSP, you save money in taxes because you get a tax deduction. There is no tax on the growth of the investments inside the RRSP. Tax is paid when money is withdrawn from the RRSP.

Related article: Online guide to RRSPs

What is a LIRA?

As long as you are employed by a company or organization with a pension, your money stays in that pension. There are two kinds of pension plans – defined benefit plans and defined contribution plans.

Related article: Pension Plans are the foundation of Retirement Planning

A LIRA is a Locked-In Retirement Account and is designed for accumulation of pension money outside a pension plan. If you do not need income from your pension funds, then a LIRA allows you to manage your pension funds personally. A LIRA is just another type of registered account much like an RRSP. Think of them both as ‘buckets’ of money.

Locked in Retirement accounts (LIRAs) are accounts that hold pension funds once you are no longer employed or part of the pension plan. If you have a LIRA it’s because you were part of a pension plan with a previous employer.

When you leave and employer prior to retirement, you will be given an options package from the pension plan. You may have the choice to move the money into a personal plan but any locked in portion of the pension must go into a LIRA.

But when you leave that company, Many people assume you can move pension money into a RRSP but that can only happen if it is a relatively small amount of money.

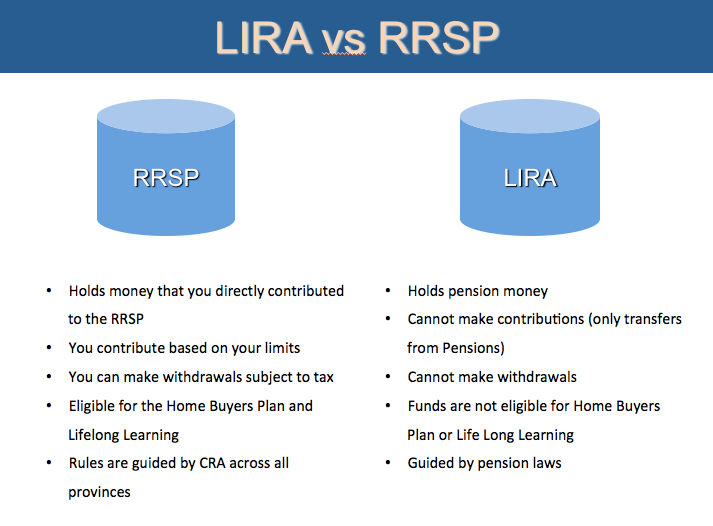

Differences between LIRAs and RRSPs

Here are some of the common differences between LIRAs and RRSPs

- LIRAs hold pension money. RRSPs hold money that you have directly contributed on your own. Because Locked-In Retirement Accounts hold pension money, you cannot make direct contributions into a LIRA. The money has to be transferred in from a pension.

- With RRSPs, you can take money out whenever you want and there are no restrictions on how much money you can take out. Any withdrawals are subject to taxation. Although it may not be ideal, you can cash out all of your RRSPs at once. With LIRAs, you are restricted on withdrawals. Firstly, you cannot take out lump sum withdrawals out of a Locked-in Retirement Account hence why that are called ‘Locked-in’. If you want income, you must move the money into a LIF or Life Annuity.

- With RRSPs, you are eligible to participate in the Home Buyers Plan and the Lifelong Learning Plan. Any funds in a LIRA are not eligible for these programs.

- LIRAs are guided under pension law, which is provincially regulated. As a result, the rules can differ from province to province. RRSPs are regulated through the income tax act so the rules are the same across Canada.

Similarities between LIRAs and RRSPs

LIRAs and RRSPs also have some similarities when it comes to tax and investment options:

- The taxation of the plans are essentially the same. As long as the money stays in the LIRA or RRSP, there is no tax on the growth. Tax is payable on the withdrawals or income created from these account. Technically, LIRAs do not allow withdrawals or income so there is no tax. LIRAs can be converted to a LIF or an annuity if income is desired.

- All of the investment options available in the RRSP are essentially the same as the investment options in the LIRA. You can invest in many different types of investments like GICs, bonds, mutual funds, stocks, etc.

What is a LIF?

When you eventually need to move from the accumulation phase in life to the income phase, a Life Income Fund (LIF) is one of the options for income. A LIF is used to convert LIRA money to income just like a RRIF is used to convert RRSPs to income. Just like the LIRA has similarities to the RRSP, the LIF has a lot of similarities to the RRIF.

- A Life Income Fund is designed to create regular income. If we used the bucket analogy, the LIF and the RRIF are just buckets with holes in them.

- In both cases, there is a minimum income that must come out of then plan.

- Income is only taxed when you receive income.

- In both the RRIF and the LIF, you can invest in many different types of investments like GICs, bonds, mutual funds, stocks, etc.

The big difference between the LIF and a RRIF is that the LIF not only has a minimum income but also a maximum income that prevents you from spending the money too quickly.

Comments

Great details as always Jim!

Mark

Good information. Can I set up a Self-directed LIRA, similar to Self-directed RRSP?

Thanks.

Yes, it is possible to set up a Self-directed LIRA

Jim just wondering if using a high dividend profile to increase funds for further investing into other stocks or drip is allowed in a LIRA? Thanks

What age can we withdraw money from LIRA? Is it possible to use it as in-kind contribution to RRSP?

It depends on the province that the pension originates from . Every province has it’s own pension legislation. In most provinces, the earliest age you can start income is age 55. Some provinces allow you to start income as early as age 50.

I am not sure about an “IN KIND” transfer from a LIRA to RRSP but if I suspect the answer is No. You should check with your financial institution to make sure

Thaqnks a lot Mr. Jim Yih

Your explaination is short and clear enught to understand really you did amazing jib

I understand by age 71, one must convert RRSP into RRIF. Is there such age limitation on LIRA?

Hey Danny,

Sorry but just to confirm you can have a LIRA that won’t impact your RRSP contributions right? I left my DB Plan last year and transfered all the funds to a LIRA. I am now looking to max out my RRSP contributions so just want to make sure it’s two completely different things 😉

Thanks!

Hi Jim. What would be the advantage or disadvantage to leaving RRSP monies in the RRSP and just taking out as needed versus converting to a RRIF and LIF before age 71. I’m thinking there would be more freedom in controlling the income from those RRSP’s instead of the government eeking out what they say are the limits or maximum limits. The taxes would be the same, would they not?

The taxes would be the same regardless of where you removed the funds from (rrsp or rrif) as taxes are a function of total income for the year. Thing is that withdrawals from rrsp can be expensive because the financial institution has to deregister the portion you want to withdraw from the rrsp so you will be hit with an administrative fee each and every time you draw. The rrsps are set up for deposits, the rrif S are set up for withdrawals. If you only want to take out smaller amount why not open a rrif and transfer to your rrif the amount needed from your rrsp. This way you can draw what you want from your rrif and keep your rrsp active.

Can you recieve EI in Canada if you are withdrawing from a LIRA.

Hi Jim

I am in Ontario and my company has started the Windup of our company pension that was frozen a few years ago. We are now being given a lump sum payment that needs to go into a locked in retirement vehicle. We have an existing DC plan with matched contributions’ can my lump sum be transferred into this account? I am also being given a cash lumpsum payout that unfortunately is being taxes at 30% as they say the contract they made with the government does not allow a direct move into an RRSP, have you heard this before?

So it’s MY Money, I need it NOW, not when the government decides I need it, this is not a Nanny state (province). The Government should NOT be deciding for what reason or when i get my money or for what I use it for. I worked for this pension from my previous company and should be allowed access to MY money when I determine I need it, NOT when some well off tribunal decides.. perhaps they should come and live with me for a month.

Jim,

If I transfer a portion, I.e. 50% of my relatively small LIRA balance to my RRSP, as permitted in Ontario after I’ve retired and am past age 55, does the transfer reduce my total RRSP contribution limit?

Hi Jim,

I learn so much from your articles. I am 54 and I am thinking about removing my DBP pension funds to a LIRA and receiving the rest in a cash payment. I understand the cash portion will be taxed at about 30% – my retirement fund will send that amount to the CRA before releasing the funds to me. What suggestions do you have for reducing the overall tax burden when completing this transaction. I still RRSP contribution room – about 50,000, and my husband has about 100,000. Should we be looking to optimize those contributions first?

We will be mortgage free within the year and are looking forward to selling our current place, retiring early and moving to a more moderate climate within Canada.

I lost my job and I want to transfer my locked in RRSP from Manulife to my self directed RRSP account with TD. Is it possible or I need to open another LIRA account with TD?

Hi I have a lira account and I am non resident living in US for 20 years, while I understand I cannot take any money out can I convert it to RRIF or LIF I will be turning 71 in June 2022 but I want access to my money now… I assume to cash in the full amount will not benefit me what do you recommend… ?

Hi Jim,

I live in Alberta and am turning 65 this year and retiring. I have a LIRA and and RRSP. Can you tell me if there is an order I should access these funds in? LIRA first or RRSP first or both at once?

Thanks,

Question: I left a company that I hadn’t been with for long and had to open a LIRA for a measly $16k. I am 55 and still working and am considering transferring 50% of this LIRA to an RRSP (via LIF). I’ve got about $15k of RRSP room this year. Would I actually have to pay any tax on any portion of this transaction? If yes, should I just leave this $16k in the LIRA and start to withdraw it when I do, in fact, retire? Wondering about tax advantages/disadvantages to transferring it now vs. a straight withdraw from the LIRA via LIF later on when I’m in fact retired and drawing on my Pension from another company.

If I have $55,000 loss in my LIRA account does it make sense to sell and take a loss for tax purposes? How much a loss can I take? Alberta Canada